“`html

Nvidia’s Dominance in AI Hardware

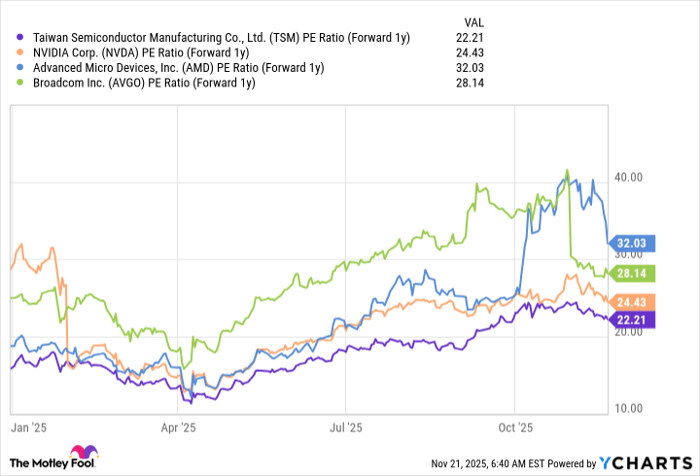

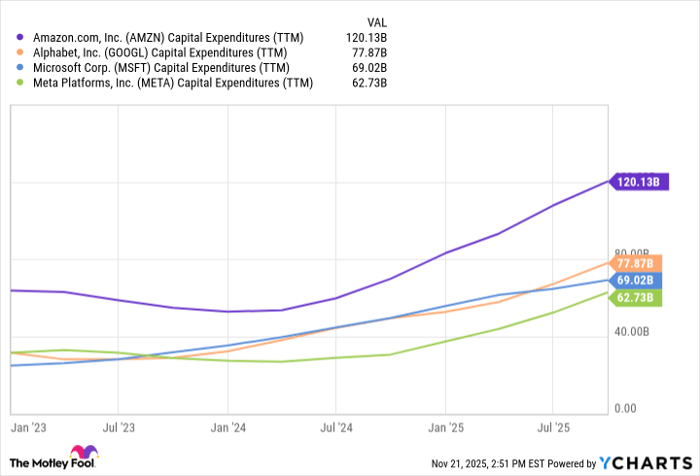

Nvidia (NASDAQ: NVDA) reported a 62% increase in revenue for Q3, totaling $57 billion, with diluted earnings per share rising by 67%. Its GPUs dominate the AI accelerator market, and the company anticipates that global data center capital expenditures will reach between $3 trillion and $4 trillion by 2030.

AMD and Broadcom’s Competitive Push

AMD (NASDAQ: AMD) is projecting a 60% compound annual growth rate in its data center division through 2030. Meanwhile, Broadcom (NASDAQ: AVGO) saw a 63% year-over-year revenue increase to $5.2 billion and forecasts growth to $6.2 billion in Q4 by developing custom AI chips.

Taiwan Semiconductor’s Strategic Position

Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) experienced a 41% revenue increase year-over-year, primarily driven by demand for AI computing hardware, placing it in a favorable position as a key supplier for Nvidia and AMD.

“`