AI Investment Insights

Alphabet (NASDAQ: GOOGL), the parent company of Google, generated $74.1 billion in revenue from its core digital advertising business in the third quarter of the fiscal year. The company’s robust profit margins allow it to fund artificial intelligence (AI) initiatives, positioning it as a strong investment in the AI space. Alphabet continues to expand its operations, including its autonomous ride-hailing service, Waymo, and efforts in quantum computing.

Tesla (NASDAQ: TSLA) is focusing heavily on AI, particularly through its humanoid robot, Tesla Optimus, which CEO Elon Musk claims could become a significant part of the company’s value. The humanoid robotics market could reach $5 trillion by 2050, though Tesla’s automotive division has recently faced challenges. Investors should weigh the inherent risks associated with Tesla’s ambitious projects against its past performance.

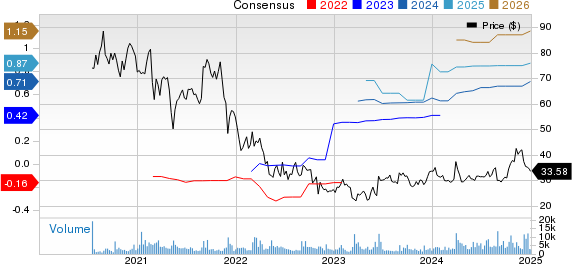

International Business Machines (NYSE: IBM) stands out as a rare dividend-paying stock in the AI landscape, offering a yield of 2.2%. IBM has been in the technology sector for decades, focusing on hybrid cloud computing and AI consulting services while expanding its AI capabilities through acquisitions. Analysts project IBM’s earnings to grow at a high-single-digit annualized rate over the next three to five years, supporting its longstanding dividend increases.