“`html

AI Investment Surge Continues

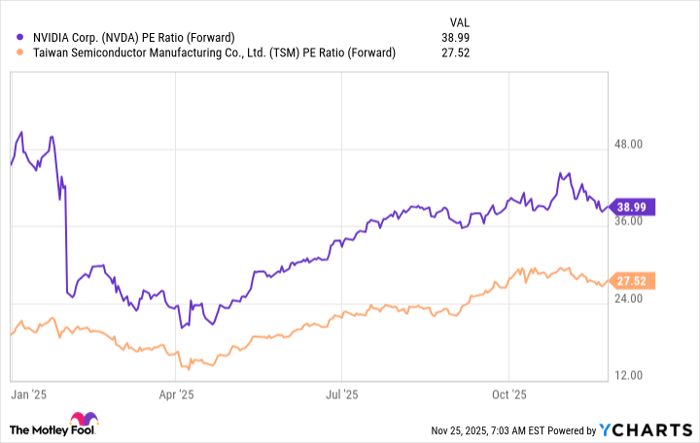

Despite a mid-November dip, investments in artificial intelligence (AI) are rebounding as companies plan record-breaking capital expenditures pushing towards 2026. Nvidia (NASDAQ: NVDA) and Taiwan Semiconductor Manufacturing (NYSE: TSM) are expected to benefit largely from this spending surge.

Nvidia Highlights

Nvidia reported a 62% revenue growth in Q3 FY 2026, translating to $500 billion in estimated demand for its Blackwell and Rubin data center GPUs by the end of 2026. This positions Nvidia for substantial growth amid a projected annual global data center capital expenditure of $3 trillion to $4 trillion by 2030.

Taiwan Semiconductor’s Growth

In Q3, Taiwan Semiconductor’s revenue rose by 41% year-over-year, aided by demand from AI hyperscalers. The upcoming launch of its 2-nanometer chip node, expected to consume up to 30% less power compared to previous generations, is anticipated to further enhance its financial performance in 2026.

“`