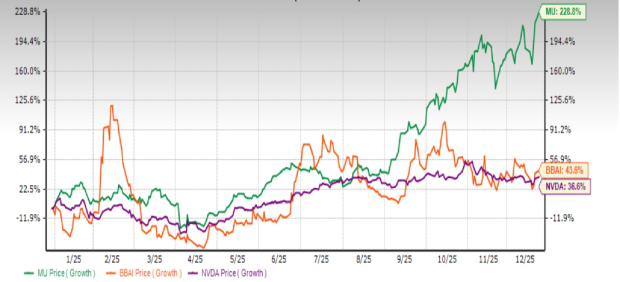

NVIDIA Corporation (NVDA) shares have risen 36.6% in 2023, driven by high demand for its CUDA software platform and Blackwell AI chips, with plans to ship H200 AI chips to China before the Lunar New Year. However, the company faces challenges from U.S.-China trade tensions and rising competition from Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC).

Micron Technology, Inc. (MU) reported revenues of $13.64 billion for its fiscal first quarter, a 56.8% year-over-year increase. The company anticipates revenues between $18.3 billion and $19.1 billion for the fiscal second quarter of 2026, with an expected earnings per share (EPS) of $8.22 to $8.62. BigBear.ai Holdings, Inc. (BBAI) is projected to have sales of $125 million to $140 million following its acquisition of Ask Sage, designed for secure AI deployment, and has an expected earnings growth rate of 73.1% for the next year.

Overall, both Micron and BigBear.ai are seen as compelling investments amidst the ongoing AI boom, with Micron holding a Zacks Rank #1 (Strong Buy) and BigBear.ai at Rank #2 (Buy).