Top Construction Stocks for Spring and Summer Growth

As we move into the peak seasons for industrial production this spring and summer, several stocks in the construction and industrial products sector ranked Zacks Rank #1 (Strong Buy) might see significant gains.

Despite the impact of tariffs on construction activities, these highly rated stocks have likely accounted for potential risks associated with higher prices for imported materials.

EMCOR Group: A Leader in Mechanical and Electrical Construction

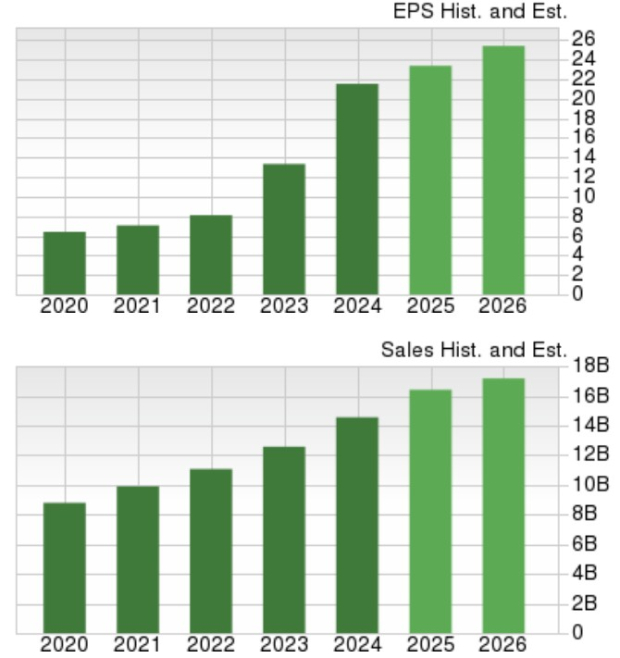

EMCOR Group’s EME is currently priced at $375 per share, down 31% from its 52-week high of $545. This top provider of mechanical and electrical construction serves a variety of clients including commercial, industrial, utility, and institutional sectors. EMCOR’s total sales are anticipated to grow by 13% in fiscal 2025 and an additional 4% in FY26, reaching approximately $17.19 billion.

On the earnings front, EMCOR is expected to see annual profits rise by 8% this year, with projections of another 9% increase in FY26 to a remarkable $25.40 per share. Furthermore, EMCOR operates at a reasonable 15.1x forward earnings multiple and under 2x sales, underscoring its strong financial position.

Image Source: Zacks Investment Research

Meritage Homes: An Undervalued Builder of Single-Family Homes

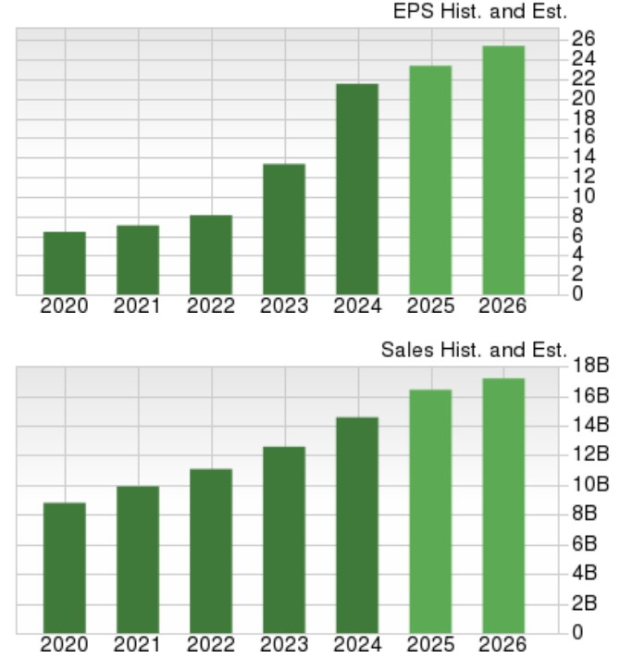

Meritage Homes MTH, a prominent designer and builder of single-family homes in the U.S., is currently trading near its 52-week low of $59 per share. At this level, MTH is valued at just 7x forward earnings, which is a discount to the Zacks Building Products-Home Builders Industry average and well below the S&P 500’s 20.8x. Additionally, MTH offers a substantial 2.58% annual dividend yield.

Image Source: Zacks Investment Research

Following a record year with an EPS of $21.44, Meritage is expected to experience some earnings contraction. However, its earnings potential suggests that investing at these levels could be advantageous, especially as MTH appears to be oversold.

Image Source: Zacks Investment Research

Sparking Growth in Infrastructure: Sterling Infrastructure

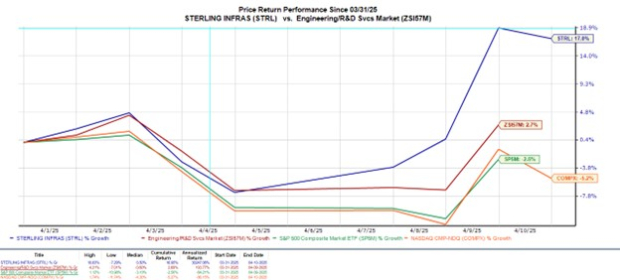

Sterling Infrastructure STRL has been expanding rapidly, positioning itself as essential for U.S. infrastructure development, particularly in next-generation manufacturing for data centers. Recent market conditions have limited buying opportunities for STRL, though trading just over $130, it remains down 21% year-to-date. Nonetheless, over the past decade, the stock has surged approximately 3,000%, with a 17% increase just this April.

Image Source: Zacks Investment Research

Conclusion: Outlook for Construction Stocks

As warmer months for construction activity approach, significant upside potential exists for EMCOR Group, Meritage Homes, and Sterling Infrastructure. The recent market volatility presents an optimal opportunity to consider these stocks.

Discover 7 Top Stocks for the Coming Month

Experts have curated a list of 7 select stocks from the current Zacks Rank #1 Strong Buys, predicting these stocks as “Most Likely for Early Price Pops.”

Since 1988, this full list has outperformed the market by more than 2X, with an average annual gain of +23.9%. Consider reviewing these handpicked top performers for potential investment opportunities.

EMCOR Group, Inc. (EME): Free Stock Analysis Report

Meritage Homes Corporation (MTH): Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL): Free Stock Analysis Report

This article was originally published on Zacks Investment Research.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.