Exploring Investment Opportunities in AI-Driven Data Center Stocks

If you’re considering a modest investment in stocks aimed at diversifying your portfolio while capitalizing on growth, the AI/data center sector is worth examining. While Vertiv (NYSE: VRT) and nVent (NYSE: NVT) may not be top-of-mind when thinking of profiting from the surge in artificial intelligence (AI) applications and data center spending, they present distinctive opportunities for savvy investors. Both companies supply essential solutions that cater to data centers, providing alternative pathways to engage with this rapidly expanding market.

Vertiv: An Underrecognized Player in Data Centers

Vertiv specializes in digital infrastructure for data centers and communication networks, offering products like power management solutions, switchgear, thermal management systems, and monitoring infrastructure. The company was acquired from Emerson Electric by Tom Gores’ private equity firm, Platinum Equity, in 2016, and went public in 2020. Its executive chairman, David Cote, is a former long-time CEO of Honeywell.

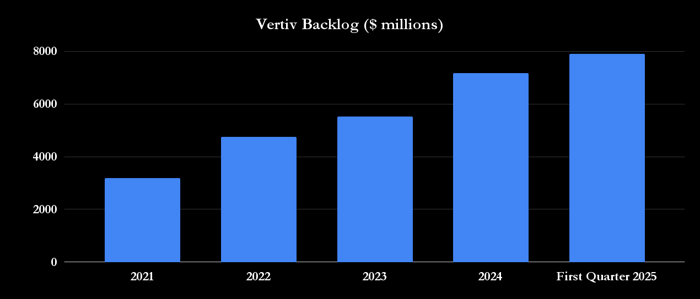

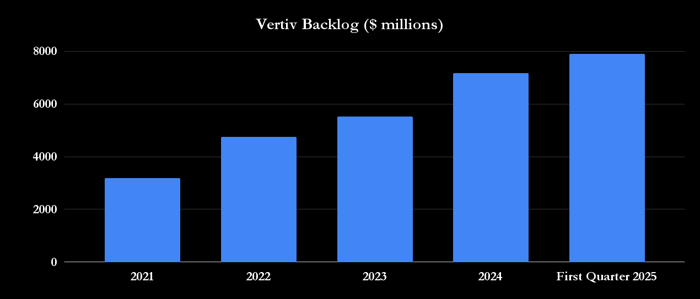

Currently well-positioned to leverage the increasing investment in data centers, Vertiv has experienced significant backlog growth. This upward trend continues, with backlog rising 10% from the end of 2024 through the first quarter.

Data source: Vertiv presentations. Chart by author.

Due to the strong orders and backlog growth, management increased the midpoint of its annual organic revenue growth forecast to 18%, up from 16%. However, profit margins and cash flow guidance remain unchanged given uncertainty over tariffs. Despite this, analysts anticipate Vertiv will generate $1.3 billion in free cash flow (FCF) by 2025, with expectations of $1.65 billion and $1.79 billion in 2026 and 2027, respectively.

Currently, with a market capitalization of $36.1 billion, Vertiv trades at 28 times and 22.5 times FCF for 2025 and 2026. While these valuations aren’t exceptionally low, they may appear attractive if the demand for AI and data centers grows further.

Image source: Getty Images.

nVent Expands Its Footprint in Power Utilities and Data Centers

nVent provides electrical connection and protection solutions across various sectors, including industrial, commercial, and residential markets. Recently, the company has focused on enhancing its exposure to data centers and power utilities, which are essential for energy supply. This strategic pivot involved divesting its thermal management business in January and acquiring the electrical products group from Avail Infrastructure Solutions for $975 million.

Following these changes, the infrastructure segment, encompassing data solutions and power utilities, now makes up 40% of nVent’s portfolio. CEO Beth Wozniak reported that organic orders in data solutions surged in Q1, reflecting a robust double-digit growth, in contrast to the mid-single-digit growth seen across other business areas. This strength contributed to mid-teens organic order growth in Q1.

Encouraged by a solid first quarter, nVent’s management raised its sales growth forecast to 5% to 7%, from a prior range of 4% to 6%. Notably, the company also increased its earnings growth guidance to 22% to 26%, up from 20% to 24%, although it anticipates a negative tariff impact of $120 million in its estimates.

Wozniak emphasized that data solutions and power utilities are driving nVent’s expansion, noting, “As we look at data solutions and power utilities, here’s where we see that growth accelerating.” Despite concerns about a potential slowdown in data center investment ahead of earnings season and possible tariff impacts, spending in this domain remains strong.

Wall Street analysts project nVent’s earnings per share will reach $3.09 and $3.46 in 2025 and 2026, with expected free cash flow of $406 million and $561 million, respectively. At these estimates, nVent trades at less than 20 times earnings in 2025 and 17.4 times earnings in 2026, while FCF multiples sit at 24 and 17.7 for the same years. These valuations present an attractive investment opportunity.

Considerations for Investing in Vertiv

Before committing to an investment in Vertiv, be mindful of this point:

While Vertiv has shown promise, it did not make the latest list of 10 best stocks for immediate consideration by analysts. Stocks on that list have a track record of notable returns. Historically, companies like Netflix and Nvidia have delivered substantial growth for early investors.

Lee Samaha holds no positions in any of the stocks mentioned. The author reports no personal gains, and the company maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.