Investing in Safety: Hershey and MTY Food Group Offer Strong Dividends

Finding well-established companies with high dividend yields can be a challenge. However, The Hershey Company (NYSE: HSY) and MTY Food Group (OTC: MTYF.F) are currently strong contenders, both offering yields near their 10-year highs.

Both firms have seen significant declines from their recent peaks, with Hershey down 12% and MTY down 20% from their 52-week highs, making now a good time for investors to consider these dividend stocks at lower prices.

Hershey: A Stable Choice in the Snack Industry

The Hershey Company stands out for its stability, operating in sectors that are less affected by economic downturns—chocolates and snacks. Its five-year beta of 0.37 indicates that Hershey’s stock is less volatile than the overall market.

To clarify, a beta below 1 suggests a stock is generally safer during market declines. Hershey’s low beta makes it a solid choice for any investor’s portfolio—a key reason why it’s one of my daughter’s primary investment picks.

However, Hershey is currently experiencing its third-largest price drop in 30 years, trailing only the declines witnessed during the 2008 and 2000 market crashes.

This raises questions about the health of the company amidst a flourishing market.

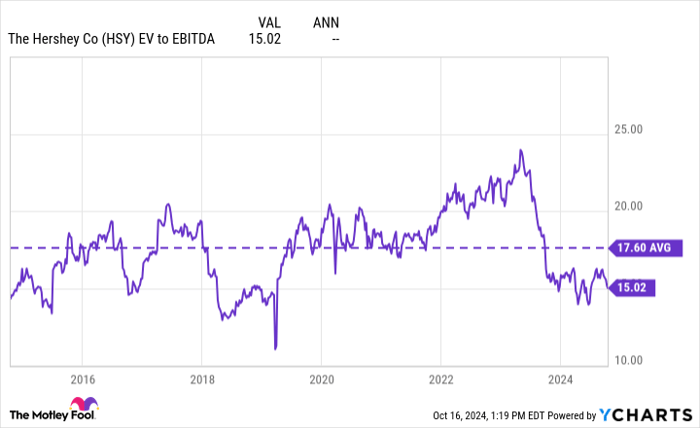

The drop in price reflects more on market valuations than Hershey’s operations. Before this decline, the company’s enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio was at a historical high of 24. Currently, it stands at 15, compared to the typical historical average of 18, highlighting a return to a more realistic valuation.

HSY EV to EBITDA data by YCharts

Hershey is also tackling short-term challenges, including a new enterprise planning system, surging cocoa prices, and shifting consumer habits. Despite these hurdles, I believe that in a decade, these issues will seem minor compared to the company’s enduring strength and brand recognition.

With well-known brands like Hershey, Kit Kat, and Reese’s, the company continues to lead its market. The acquisition of brands like Skinny Pop and Dot’s Homestyle Pretzels has also been beneficial, achieving annual sales growth of 13% and 65% since 2019, respectively.

On the dividends side, even with recent challenges, Hershey has increased its dividends twice in three quarters, resulting in a 32% overall hike in payments. This uses only 55% of net income, suggesting ample opportunity for further dividend growth.

HSY Dividend Yield data by YCharts

Although Hershey may not experience massive stock price gains shortly, its 2.9% dividend yield, stable market position, and effective acquisitions make it a reliable long-term investment.

MTY Food Group: Stability Through Diversification

In contrast to Hershey, MTY Food Group finds its strength through a diverse brand portfolio. The company manages around 90 quick-service food brands that cover a variety of cuisines and seasonal options.

Image Source: MTY Food Group Investor Presentation.

MTY’s assortment of offerings means that while frozen treat brands thrive in summer, other labels like Wetzel’s Pretzels perform well in winter. This seasonal diversification provides a stable revenue stream.

Additionally, MTY operates primarily as a franchisor, with about 7,000 locations, most of which are franchise-operated. This model minimizes risk and capital investment, leading to stable free cash flow (FCF) margins.

Remarkably, even during the pandemic, MTY maintained a 20% FCF margin, although it currently stands at 15%. Despite ongoing economic challenges, MTY has demonstrated exceptional FCF growth over the past ten years.

MTYFF Free Cash Flow data by YCharts

Over the last decade, MTY has completed 27 acquisitions worth over $1.7 billion, using its robust FCF to invest in growth opportunities—creating a positive feedback loop for future returns.

The company’s 2.3% dividend yield is currently at a decade-high, aside from the 2020 market drop. Impressively, just 14% of MTY’s FCF is utilized for dividends, indicating possible future payout increases.

With an EV/FCF ratio of 10, MTY is also prioritizing share buybacks, capitalizing on its lower stock price following market dips. Since 2019, MTY has reduced its share count by 1.2% annually, amplifying its return to shareholders through dividends.

With strong FCF generation and a proven strategy for acquisitions, MTY looks poised to continue rewarding investors with growing dividends for the long term.

Should You Invest $1,000 in Hershey Now?

Before making any investment in Hershey, consider this:

The Motley Fool Stock Advisor analyst team has highlighted what they believe are the 10 best stocks to invest in right now, and Hershey was not among them. The chosen stocks have the potential for high returns in the upcoming years.

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would now be worth $845,679!*

Stock Advisor offers an investor-friendly guide for success, including portfolio-building strategies, expert updates, and two new stock recommendations monthly. This service has substantially outperformed the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Josh Kohn-Lindquist has investments in Hershey and MTY Food Group. The Motley Fool also has positions in and recommends both companies. For details, see the Motley Fool’s disclosure policy.

The views expressed here represent the author’s opinion and do not necessarily reflect those of Nasdaq, Inc.