Two Buy-Ranked Stocks Offering Strong Dividend Yields

Here are two stocks with a buy rank and solid income characteristics for investors to consider on April 17th:

Suzano S.A. Overview

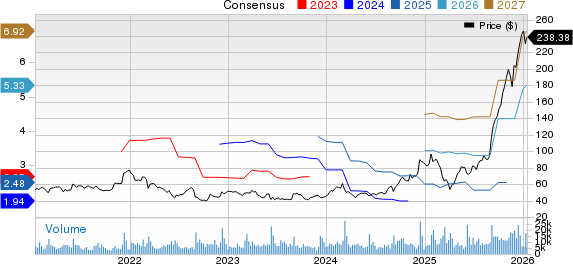

Suzano S.A. (SUZ): This company specializes in eucalyptus pulp and paper products and has seen a 9.8% increase in the Zacks Consensus Estimate for its current year earnings over the last 60 days.

Price and Consensus for Suzano S.A.

Suzano S.A. Sponsored ADR price-consensus-chart | Suzano S.A. Sponsored ADR Quote

This Zacks Rank #1 company boasts a dividend yield of 3%, which is significantly higher than the industry average of 1.4%.

Dividend Yield for Suzano S.A.

Suzano S.A. Sponsored ADR dividend-yield-ttm | Suzano S.A. Sponsored ADR Quote

Arcadis NV Overview

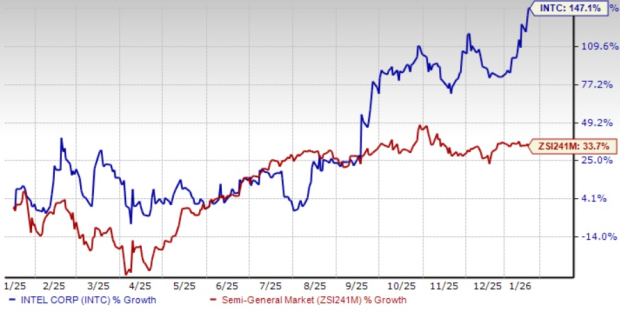

Arcadis NV (ARCAY): This global design, engineering, and management consulting firm also holds a Zacks Rank #1. The Zacks Consensus Estimate for this company’s current year earnings has increased by 3.3% in the past two months.

Price and Consensus for Arcadis NV

Arcadis NV price-consensus-chart | Arcadis NV Quote

Arcadis NV offers a dividend yield of 1.6%, which exceeds the industry average of 0.0%.

Dividend Yield for Arcadis NV

Arcadis NV dividend-yield-ttm | Arcadis NV Quote

To explore a full list of top ranked stocks, click here.

For more top income stocks, consider checking out some of our great premium screens.

Just $1 for Full Access to Zacks’ Buys and Sells

No, this is not a gimmick.

Years ago, we introduced a program that allows members to access all our stock picks for just $1, with no further obligations.

Many have seized this opportunity, while others hesitated, expecting a catch. The motivation is simple; we want you to experience our portfolio services, like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which achieved 256 positions with double and triple-digit gains in 2024 alone.

Arcadis NV (ARCAY) : Free Stock Analysis Report

Suzano S.A. Sponsored ADR (SUZ) : Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.