MercadoLibre: An Investment Opportunity Amid Recent Challenges

MercadoLibre (NASDAQ: MELI) has proven to be a solid investment for patient, long-term shareholders. However, the company has experienced a downturn since its latest earnings report, with the stock declining approximately 20% over the past two months.

This drop resulted from disappointing earnings and some valid concerns about profitability. Nevertheless, this moment may offer a valuable opportunity for long-term investors to purchase shares. MercadoLibre’s core business is growing quickly, and multiple upcoming catalysts could significantly increase revenue in coming years.

Start Your Mornings Smarter! Wake up with Breakfast News delivered to your inbox every market day. Sign Up For Free »

It’s worth noting that MercadoLibre’s stock price is around $1,700. Therefore, investors who want to purchase $500 worth of stock will need to work with a broker that provides fractional share investing. This approach can effectively help investors grow their portfolios.

Profit Challenges Persist, Yet Growth Remains Strong

The primary reason for MercadoLibre’s stock decline post-earnings was the company’s failure to meet profit expectations. In the third quarter, the EBIT margin fell by 7.4 percentage points compared to the previous year due to higher growth investments and bad debt, leading to negative free cash flow.

This situation deserves close monitoring. However, it’s essential to recognize that MercadoLibre’s overall business continues to expand significantly. The e-commerce marketplace sold 28% more items compared to a year ago and welcomed over 10 million new active buyers. Furthermore, the Mercado Pago payment processing segment grew by 34% year over year, achieving an annualized payment volume exceeding $200 billion. Additionally, the credit business, though relatively new, boasts $6 billion in outstanding loans—a 77% increase from the third quarter of 2023.

Key Reasons to Consider MercadoLibre Now

First, MercadoLibre’s core divisions have considerable potential for future growth. E-commerce penetration in the United States is around 16% of total retail, with even lower rates in Latin America, where MercadoLibre operates. The same applies to cashless payment adoption, especially given the large number of underbanked and unbanked individuals in the region.

Latin America comprises more than 650 million people, nearly twice the U.S. population. As logistics improve in the region, significantly more buyers and sellers will likely engage online.

Additionally, MercadoLibre has several other businesses that are in early stages but show exceptional promise. For instance, the credit card division among its services nearly tripled in size over the past year. The investment platform, still in its early phases, experienced a 93% increase in assets under management during the last quarter.

Moreover, the Mercado Ads platform is beginning to diversify beyond product advertising, potentially becoming a significant source of high-margin revenue in the years ahead. The recent introduction of a two-tiered MELI+ subscription service, akin to Amazon‘s (NASDAQ: AMZN) Prime, aims to enhance user engagement across the company’s offerings.

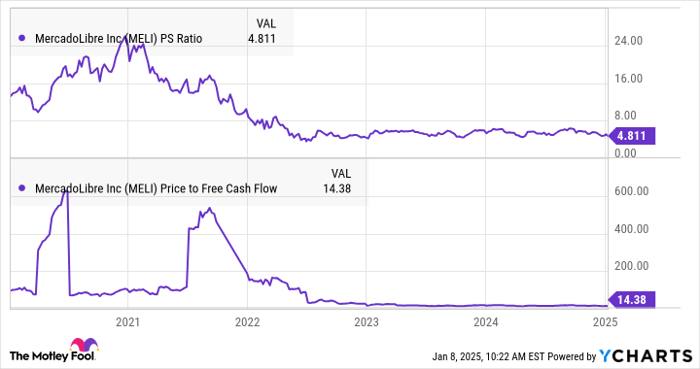

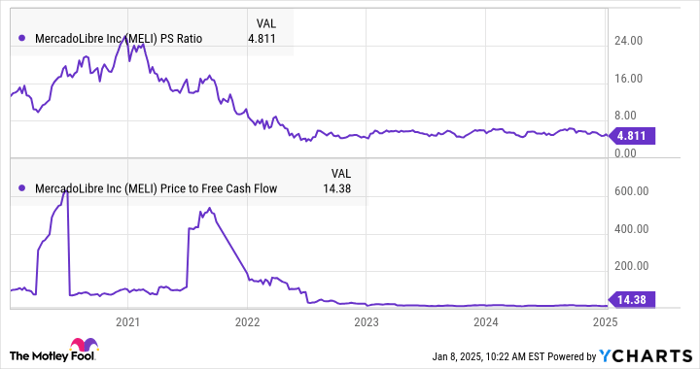

Valuation is another important factor. Despite the stock’s roughly 180% increase over the past five years, the company’s remarkable growth has decreased its valuation based on several metrics. Currently, MercadoLibre’s price-to-sales ratio is about 64% lower than it was five years ago. The company’s trailing-12-month free cash flow trades at a historically low multiple of just 14.5, contrasted with about 96 at the beginning of 2020.

MELI PS Ratio data by YCharts

Conclusion: The Case for MercadoLibre

Although MercadoLibre has seen a 20% drop from recent highs, its stock has become even more reasonably priced based on various metrics. Given the outstanding growth potential and massive opportunities ahead, MercadoLibre ranks highly on my buy list as we approach 2025, even as it already constitutes one of my largest investments.

Should You Invest $1,000 in MercadoLibre Right Now?

Before making an investment in MercadoLibre, consider the following:

The Motley Fool Stock Advisor analyst team has recently highlighted what they identify as the 10 best stocks for investors to consider, and MercadoLibre was not included among them. The featured stocks are expected to yield significant returns in the coming years.

Reflect on when Nvidia appeared on this list on April 15, 2005… if you had invested $1,000 at that time, it would be worth $832,928 today!*

Stock Advisor offers investors a straightforward plan for success, including portfolio-building assistance, regular analyst updates, and two new stock recommendations each month. The Stock Advisor service has generated more than quadrupled the return of the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Matt Frankel has positions in Amazon and MercadoLibre. The Motley Fool has positions in and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.