Can Archer Aviation Lead the eVTOL Market’s Revival?

Developers of electric vertical take-off and landing (eVTOL) aircraft made headlines in 2021 by merging with special purpose acquisition companies (SPACs). Back then, investors were excited about these companies’ partnerships and optimistic long-term projections, despite the absence of any commercial aircraft deliveries.

Many enthusiasts believed these eVTOL aircraft, reminiscent of drones, could take over traditional helicopters. They were seen as cheaper, greener, quieter, and more suited for urban settings. Major players like the U.S. Air Force, airlines, automakers, and ride-sharing companies envisioned using them as air taxis. According to Markets and Markets, the eVTOL market is projected to grow at a remarkable compound annual growth rate (CAGR) of 52% from 2023 to 2030.

Where should you invest $1,000 now? Our analysts have just unveiled what they consider the 10 best stocks for immediate investment. See the 10 stocks »

Image source: Archer Aviation.

Today, however, the excitement surrounding these SPAC-backed eVTOL stocks has faded, as they now trade far below their previous peaks. Factors such as delivery delays, unmet expectations, and significant losses dampened investor enthusiasm. Additionally, rising interest rates reduced the market’s interest in speculative companies that haven’t generated revenue yet.

Nevertheless, as interest rates begin to decrease, it may be time for investors to reconsider the eVTOL sector. One stock I believe holds significant promise is Archer Aviation (NYSE: ACHR), which could potentially turn a $2,000 investment into much larger returns over the next decade.

What Makes Archer Aviation Stand Out?

Archer’s Midnight eVTOL aircraft boasts a range of up to 100 miles at a speed of 150 miles per hour on a single charge. It can accommodate a pilot and four passengers. Competitors like Joby Aviation (NYSE: JOBY) and EHang are also working on eVTOL aircraft, but Archer has forged a broader array of partnerships compared to many of its rivals.

In 2021, United Airlines made headlines with a $1 billion order for 200 Midnight aircraft, followed by a $10 million deposit for the initial 100 aircraft in 2022. In 2023, automaker Stellantis invested in Archer, selecting it as the exclusive manufacturer for its eVTOL aircraft.

Since 2021, Archer has collaborated with the U.S. Department of Defense (DOD), expanding that relationship with contracts worth up to $142 million in 2023. They delivered their first aircraft to the U.S. Air Force last August. More recently, last November, a joint venture called Soracle, formed by Japan Airlines and Sumimoto, placed a $500 million order for 100 Midnight aircraft.

These promising deals position Archer Aviation favorably amid competitors that may lack similar backing.

Why Archer Might Be the Top Choice for eVTOL Investment

Although Joby Aviation is making strides—including major investments from Toyota and Delta, alongside a long-term DOD contract—it appears Archer may offer a more compelling investment for several reasons.

First, Archer has outlined a clearer growth strategy. They plan to increase annual aircraft production to 10 in 2025, 48 in 2026, 252 in 2027, and 650 in 2028. Additionally, Archer aims to establish dedicated air taxi routes soon. Conversely, Joby hasn’t shared similar production targets.

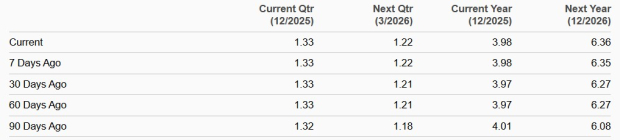

Second, Archer is projected to grow revenues at a quicker pace than Joby. Revenue forecasts for 2026 are $185 million for Archer compared to $98 million for Joby. While these figures are speculative, Archer’s growing partnerships and support from Stellantis could bolster its growth potential.

Third, Archer’s valuation appears more favorable. With an enterprise value of $3.5 billion, Archer sits at 19 times its projected 2026 sales. Comparatively, Joby’s enterprise value is $5.9 billion with a staggering 60 times its projected sales for the same year, raising questions about its higher valuation given its slower growth prospects.

Lastly, insider trading activity favors Archer. Over the past year, Archer’s insiders purchased 12 times more shares than they sold, while Joby’s insiders sold nearly twice as many shares as they bought. This suggests a more optimistic outlook regarding Archer’s potential growth.

While Archer Aviation’s stock may experience volatility in the coming years, if the company achieves its ambitious goals, it could experience significant growth as eVTOL air taxis become more common.

Is Now the Right Time to Invest in Archer Aviation?

Before making any investment decisions regarding Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investment at this moment—and Archer Aviation is not on the list. The stocks they recommend could yield substantial returns in the coming years.

Reflect on when Nvidia was included on this list back on April 15, 2005… an investment of $1,000 at that time would now be worth approximately $863,081!

Stock Advisor provides a user-friendly guide for investors, featuring portfolio building tips and regular updates, along with two new stock suggestions each month. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002.

Learn more »

*Stock Advisor returns are as of January 21, 2025.

Leo Sun does not hold any position in the stocks mentioned. The Motley Fool recommends Delta Air Lines and Stellantis. The Motley Fool maintains a disclosure policy.

The views expressed here are solely those of the author and do not represent the opinions of Nasdaq, Inc.