Amazon’s Growth Potential: Why It Remains a Top Investment Choice

Legendary investor Peter Lynch famously advocated for the strategy of investing in what you know. This approach helps investors better gauge a company’s growth prospects based on familiarity and understanding.

One example of a company that fits this framework is Amazon (NASDAQ: AMZN). Like many Americans, I frequently use its products and services, underscoring my daily connection to the company.

Nonetheless, simply using Amazon’s services doesn’t automatically make its stock a wise investment. Yet, I firmly believe it is a sound choice for many investors. In fact, I consider Amazon to be a leading growth stock for those looking to invest $1,000 right now.

Image source: Getty Images.

Diverse Growth Areas: E-commerce, Cloud, and AI

Looking at my Amazon account, my wife and I have placed 37 orders in 2025 alone, averaging about one order every 3.5 days. Our future order frequency is likely to increase, a trend likely mirrored across the nation.

In October 2024, Amazon CEO Andy Jassy stated that the company has only captured about 1% of the global retail market. He noted that approximately 80% to 85% of retail still occurs in physical stores. Jassy expressed confidence that this market share will shift over the next 10 to 20 years, representing substantial opportunities for Amazon and its competitors.

Jassy also highlighted the growth potential for Amazon’s cloud services. During a recent quarterly earnings call, he emphasized that over 85% of global IT expenditures still occur on-premises, not in the cloud. Should this trend change, Amazon Web Services (AWS)—the largest cloud service provider—stands to greatly benefit.

Another area of growth for Amazon lies in artificial intelligence (AI). The advancements in Agentic AI and potentially artificial general intelligence (AGI) could significantly impact the company’s future.

Additionally, Amazon is expanding into healthcare, with announcements such as filling pet medication prescriptions through Amazon Pharmacy. Later this year, it plans to offer worldwide internet services through its Project Kuiper satellites. The company’s Zoox division also aims to tap into the growing robotaxi market.

A Financial Powerhouse

Despite these numerous growth avenues, Amazon would not qualify as an ultimate growth stock if it faced financial struggles. However, Amazon is indeed thriving financially.

In the first quarter of 2025, the company saw its sales rise by 9% year over year, totaling $155.7 billion. AWS contributed a sales increase of 17%, reaching $29.3 billion. Amazon’s profit for Q1 soared to $17.1 billion, an increase of over 64% from the previous year, and it generated $25.9 billion in free cash flow for the 12 months ending March 31, 2025. At the end of Q1, the company reported nearly $94.6 billion in cash, cash equivalents, and marketable securities.

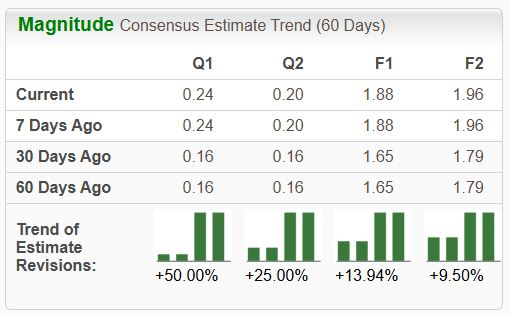

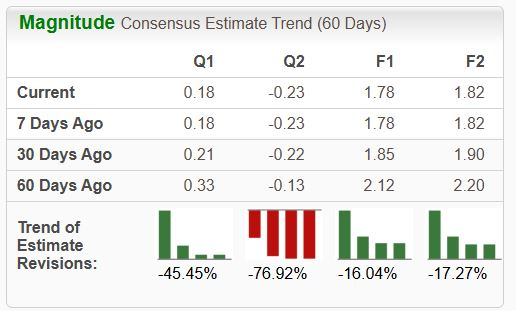

Wall Street expects Amazon’s revenue to reach around $694.5 billion for this fiscal year, with projections suggesting sales could escalate to $762 billion in 2026. Analysts are also optimistic about the company’s earnings growth moving forward.

Capitalizing on Share Price Pullback

With such strong fundamentals, one might wonder why Amazon’s stock has declined by double digits year to date. Many analysts attribute this drop to trade tariffs introduced during the Trump administration, which some investors believe could negatively impact the company’s business.

While I acknowledge that tariffs could pressure Amazon’s pricing and consumer spending, I believe this is a temporary concern. Amazon’s reputation as the lowest-price online retailer in the U.S.—a title it has held for eight consecutive years according to Profitero—could help mitigate potential repercussions.

For forward-looking investors, this recent dip in Amazon’s share price presents a notable opportunity. This growth stock may not remain available at a discount for long.

Final Thoughts: Seize the Opportunity

Sometimes, investors feel they have missed out on lucrative opportunities. The current market may be one of those moments.

In rare instances, our expert analysts issue “Double Down” stock recommendations for companies poised for significant gains. If you’ve been hesitant to invest, now could be the ideal time before these opportunities slip away. Here are a few past success stories:

- Nvidia: A $1,000 investment made when we doubled down in 2009 would be worth $302,503 today!

- Apple: $1,000 invested in 2008 would now be worth $37,640!

- Netflix: $1,000 from 2004 has grown to $614,911!

Currently, we are issuing “Double Down” alerts for three promising companies, a chance made available with membership.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board. Keith Speights has positions in Amazon, which The Motley Fool recommends. The Motley Fool follows a strict disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.