“`html

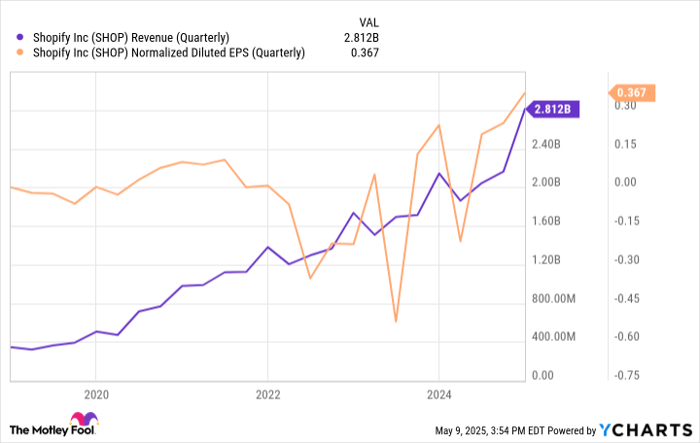

Shopify (NASDAQ: SHOP) reported its first-quarter results on [insert date], showing revenue of $2.36 billion, which exceeded estimates of $2.33 billion, but fell short of facilitating sales predictions, with $74.75 billion compared to the forecast of $74.8 billion. The company’s operating per-share earnings were reported at $0.25, surpassing an estimate of $0.18. The stock fell more than 6% in response to investor concerns.

Despite this volatility, Shopify’s revenue grew 27% year-over-year, and non-GAAP operating income increased from $201 million the previous year to $329 million. Analysts project a continued growth rate of over 24% for the direct-to-consumer market Shopify serves. Current analyst ratings suggest a strong buy, with a target price of $113.71 per share, indicating a potential upside of 25% from current levels.

As indicated by a survey from PwC, approximately two-thirds of U.S. shoppers made purchases directly from brand websites, highlighting a long-term shift in consumer behavior that favors Shopify’s business model.

“`