Micron Technology Sees Major Growth Amid AI Boom

Micron Technology (NASDAQ: MU) has shifted its focus towards high bandwidth memory (HBM) chips, which sell for four times the price of standard DRAM. As AI-driven data centers expand, the demand for these memory chips has surged, with the HBM market projected to grow from $35 billion in 2025 to $100 billion by 2028. Micron’s revenues have doubled over the past two years, and the company is experiencing a trailing net profit margin of 28%.

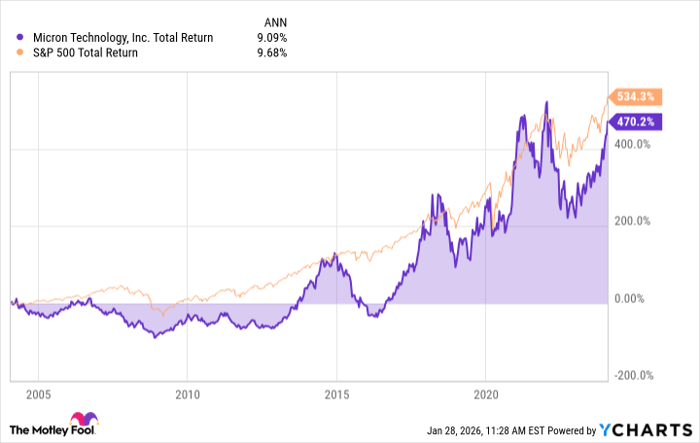

In recent months, Micron’s stock has outperformed the S&P 500, delivering a 371% return over the past year, compared to the S&P’s 16%. This growth is partly due to its partnership with Nvidia (NASDAQ: NVDA), as every Nvidia AI accelerator card incorporates Micron’s HBM memory. The company expects chip shortages to persist into 2028, indicating a potential sustained demand for its products.