“`html

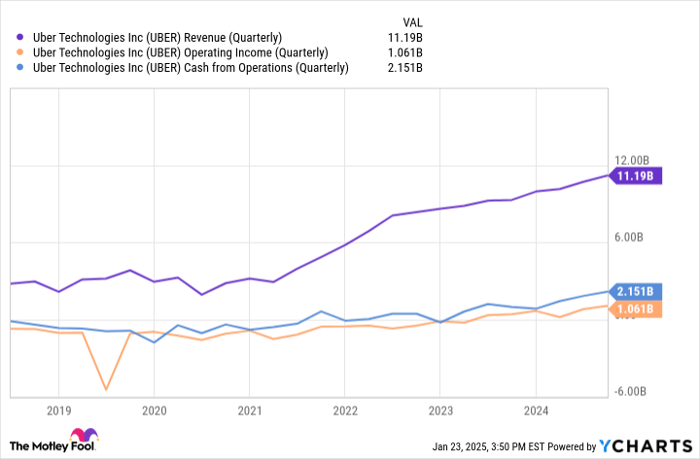

Uber Technologies (NYSE: UBER) reported a third-quarter operating income of over $1 billion, a significant increase from just under $400 million in the previous year. The company is valued at approximately $150 billion and handled nearly 2.9 billion rides in the third quarter of 2023, with total annual business nearing $40 billion. Notably, Uber’s top line improved by 20% year over year.

Uber controls approximately 76% of the U.S. ride-hailing market and is expected to capture a share of the global ride-sharing industry’s anticipated growth of 21% annually through 2032. Trends show a decline in car ownership among younger demographics, with less than 40% of teenagers holding driver’s licenses, reflecting a shift toward reliance on ride-hailing services.

Despite a 17% pullback in stock price from its October peak, analysts maintain a consensus price target of nearly $90 per share for Uber, representing a potential upside of over 30%. This positions Uber as a compelling growth investment in the expanding mobility and delivery markets.

“`