DraftKings, an online sports betting company listed on NASDAQ: DKNG, has seen significant fluctuations since its public debut in April 2020. Once boasting an all-time high in March 2021, the stock has since lost over half its value, a common fate for many young growth stocks.

Despite the hurdles ahead for DraftKings and the broader sports betting industry, the company holds promising long-term growth potential.

DraftKings Expands Beyond Sports Betting

Initially known for its daily fantasy sports and betting, DraftKings is actively diversifying its operations through strategic acquisitions. Last year, DraftKings acquired Golden Nugget Online Gaming to strengthen its presence in the thriving iGaming sector. This move has already proven fruitful. According to Eilers & Krejcik Gaming, DraftKings and Golden Nugget’s gaming apps ranked No. 1 and No. 2, respectively.

In a further expansion, DraftKings bought the digital lottery platform Jackpocket this year, tapping into the growing lottery market. The company anticipates that Jackpocket will begin contributing positively to its earnings before interest, taxes, depreciation, and amortization (EBITDA) by 2025.

By venturing beyond sports betting, DraftKings aims to mitigate risks associated with depending on a single market, allowing it to grow its customer base. Additionally, this strategy enables DraftKings to cross-sell products and significantly lower customer acquisition costs, which plummeted 40% year over year in Q2.

Clearer Path Towards Profitability

Though DraftKings prioritized gaining market share over immediate profits, recent trends suggest a shift may be on the horizon. The company projects it could achieve profitability according to generally accepted accounting principles (GAAP) standards by the end of 2025.

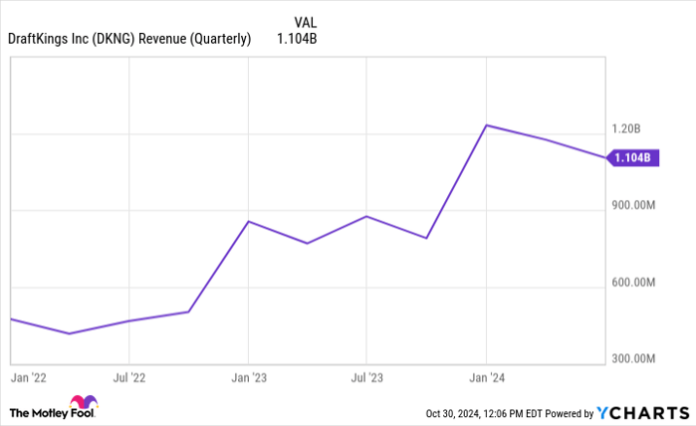

The second quarter brought in $1.1 billion in revenue, reflecting a 26% increase from the previous year. Following this successful quarter, management raised its total revenue outlook, now predicting between $5.05 billion and $5.25 billion for the year, which signifies a projected year-over-year increase of 38% to 43%.

Data by YCharts.

The anticipated adjusted EBITDA for 2025 stands between $900 million and $1 billion—an important milestone for the company. DraftKings reported an operating loss of $459 million in the first six months of 2023, a stark improvement from the previous year’s $171 million loss.

Opportunities in New Markets Await

Since the U.S. Supreme Court allowed states to regulate sports betting independently, the number of states with legalized betting has surged from just a few to 38, plus Washington, D.C., in only six years.

DraftKings has two primary avenues for growth: attracting new customers where it already operates and entering states that may legalize sports betting in the future. While timelines for the latter remain uncertain, the potential tax revenue may prompt more states to join the trend. Since June 2018, over $6.3 billion in taxes has been collected from sports betting, indicating substantial financial incentives for states to consider legalization.

As a leading platform, DraftKings is well-positioned to take advantage of both existing and emerging opportunities in the market.

Should You Invest $1,000 in DraftKings Now?

Before making a decision to invest in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted their selection of the 10 best stocks for investors to buy now, with DraftKings missing the cut. The identified stocks are expected to deliver significant returns in the coming years.

For perspective, consider when Nvidia made the list on April 15, 2005. If you had invested $1,000 at that time, your investment would now be worth $829,746!*

Stock Advisor simplifies investment success by providing a clear blueprint, ongoing analyst updates, and two new stock picks each month. The service has significantly outperformed the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of October 28, 2024

Stefon Walters has positions in DraftKings. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.