Why The Trade Desk’s Stock Drop May Be an Investment Opportunity

Some investors reacted sharply to The Trade Desk‘s (NASDAQ: TTD) fourth-quarter results, choosing to sell quickly. For the first time since its IPO in 2016, the digital advertising leader fell short of Wall Street’s revenue expectations. Following the announcement, shares dropped by 33% the next day, erasing a year’s worth of gains. Currently, The Trade Desk’s stock is down 50% from its annual high.

Analyzing The Trade Desk’s Current Valuation

This decline presents a potential buying opportunity for investors. The Trade Desk remains a high-quality growth stock. While it’s true that it trades at 90 times trailing earnings and 14 times sales, these figures have significantly declined from their previous highs. P/E ratios soared above 200 and P/S ratios peeked over 30 in recent periods. Thus, from a historical perspective, the current valuation appears more reasonable.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

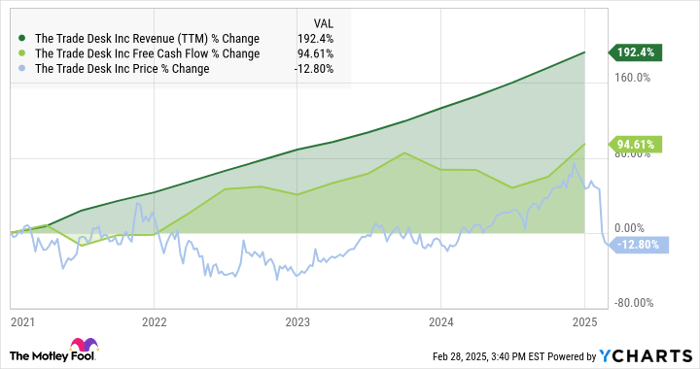

The company’s growth potential remains significant despite the recent downturn. During the inflation crisis that led to a bear market in 2022, The Trade Desk saw its stock price decline, but its business results did not reflect that downturn. As illustrated by the blue price chart below, there was no noticeable slowdown in The Trade Desk’s sales growth, and its cash profits continued to rise:

TTD Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Management’s Response and Future Strategy

The Trade Desk’s annual free cash flows have doubled in the last four years, with revenues nearly tripling. However, the stock price has declined by 12% during this same period.

Despite disappointing guidance and slower sales growth indicated in the latest earnings report, the market’s reaction seems exaggerated. The revenue miss represented a solid 22.3% year-over-year growth, just shy of a 25.2% target.

CFO Laura Schenkein took full responsibility during the Q4 earnings call, recognizing the revenue miss as an execution issue rather than a collapse in demand. To address this, The Trade Desk has outlined a comprehensive 15-point recovery plan focusing on partnerships, audio advertising, hiring more sales staff, and revising product development processes.

Understanding the Value of a High-Growth Stock

While I can’t guarantee The Trade Desk will overcome its challenges by 2025, some investors argue that the stock is still too expensive. Nonetheless, it’s essential to consider what you attain by investing. You’re paying a premium for a dynamic growth stock that boasts positive earnings and cash flow. Many high-growth companies accumulate losses before turning a profit, but The Trade Desk is achieving both growth and profitability simultaneously.

Moreover, The Trade Desk continues to lead in digital advertising technology. Its Unified ID 2.0 (UID2) standard is increasingly supported across the industry, as it prepares advertisers and ad sellers for significant market changes due to restrictions on ad-tracking services by companies like Alphabet (NASDAQ: GOOG) and (NASDAQ: GOOGL).

This makes me comfortable paying a premium for The Trade Desk’s stock. Looking ahead, I might reflect on the spring of 2025 as a time when this exceptional growth stock was available at a relative discount. Long-term investors who enter at today’s more moderate prices may reap substantial rewards.

Seize This Investment Opportunity

If you’ve ever felt you missed the chance to invest in successful companies, you won’t want to miss what’s happening now.

Our expert analysts are currently issuing a “Double Down” Stock recommendation for several companies poised for growth. If you’re concerned that you’ve missed your opportunity, the present moment is ideal for investment. The historical data is compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $323,920!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,851!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $528,808!*

Currently, we are issuing “Double Down” alerts for three incredible companies, and the window to seize this opportunity may close quickly.

Continue »

*Stock Advisor returns as of February 28, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet and The Trade Desk. The Motley Fool has positions in and recommends Alphabet and The Trade Desk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.