Three Stocks to Consider Buying Today for Strong Growth Potential

Investors looking for growth may want to take a closer look at these three stocks, each demonstrating promising characteristics as of November 11:

Greenbrier Companies, Inc. (GBX)

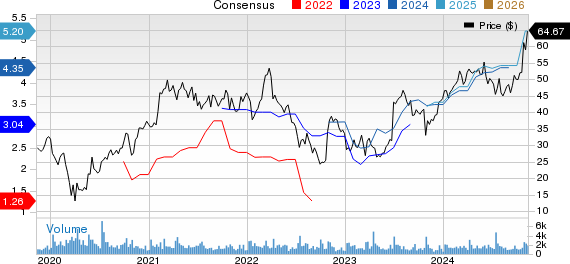

The Greenbrier Companies, Inc. (GBX): This company specializes in railroad freight car equipment and holds a Zacks Rank of #1. Over the past 60 days, the earnings estimate for this year has risen by 18.2%.

Price and Consensus for Greenbrier Companies, Inc.

With a PEG ratio of 0.53, Greenbrier is well below the industry average of 1.67. Furthermore, it has achieved a Growth Score of A.

PEG Ratio for Greenbrier Companies, Inc.

Pitney Bowes Inc. (PBI)

Pitney Bowes, Inc. (PBI): This company focuses on shipping and mailing solutions and also carries a Zacks Rank of #1. In the same period, its earnings estimate for this year has increased by 8.6%.

Price and Consensus for Pitney Bowes Inc.

Pitney Bowes reports a PEG ratio of 1.33, which is significantly lower than the industry average of 3.45. The company’s Growth Score stands at A.

PEG Ratio for Pitney Bowes Inc.

LATAM Airlines Group S.A. (LTM)

LATAM Airlines Group S.A. (LTM): This airline company serves both passengers and cargo, also holding a Zacks Rank of #1. The earnings estimate for next year has increased by 0.4% in the last 60 days.

Price and Consensus for LATAM Airlines Group S.A.

LATAM Airlines boasts a PEG ratio of 0.76, below the industry average of 1.33, and carries a Growth Score of B.

PEG Ratio for LATAM Airlines Group S.A.

For more insight on top-ranked stocks, check out the full list here.

Discover Top Clean Energy Stocks with High Growth Potential

The energy sector plays a vital role in our economy. Valued at trillions of dollars, it has birthed some of the largest and most successful companies globally.

Advancements in technology usher in new clean energy alternatives, challenging the dominance of traditional fossil fuels. As investments flood into this sector—from solar energy to hydrogen fuel cells—emerging companies could become the promising stocks you want in your portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to explore Zacks’ top picks for free today.

Stay updated with the latest recommendations from Zacks Investment Research. You can download “5 Stocks Set to Double” for free.

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Greenbrier Companies, Inc. (GBX): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.