Today, November 12, we highlight three stocks that have strong growth potential and are rated as buys, making them worthy of consideration for investors.

Investors Shine Spotlight on Top Growth Stocks

Interface, Inc. (TILE): A Touted Buy with Promising Growth

Interface, Inc.: This company specializes in modular carpet products and currently holds a Zacks Rank #1. In the past 60 days, the Zacks Consensus Estimate for its earnings for the current year has risen by 7%.

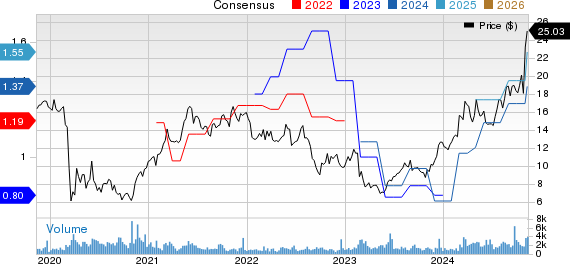

Price and Consensus Information

Interface, Inc. price-consensus-chart | Interface, Inc. Quote

With a PEG ratio of 1.22, this is a favorable figure compared to the industry average of 1.31. Moreover, the company’s Growth Score is rated at A.

PEG Ratio Summary

Interface, Inc. peg-ratio-ttm | Interface, Inc. Quote

The Progressive Corporation (PGR): Insurance Growth Leader

The Progressive Corporation: As an insurance holding company with a Zacks Rank #1, Progressive’s consensus estimate for earnings has increased by 5.8% over the last two months.

Price and Consensus Analysis

The Progressive Corporation price-consensus-chart | The Progressive Corporation Quote

With a PEG ratio of 0.72, The Progressive Corporation significantly outperforms the industry average of 1.39. Its Growth Score is also rated as A.

PEG Ratio Overview

The Progressive Corporation peg-ratio-ttm | The Progressive Corporation Quote

Vertiv Holdings Co. (VRT): A Newcomer with Robust Growth

Vertiv Holdings Co.: Known for providing shipping containers and related services, this company also holds a Zacks Rank #1. Its consensus earnings estimate has increased by 4.3% in the last 60 days.

Price and Consensus Update

Vertiv Holdings Co. price-consensus-chart | Vertiv Holdings Co. Quote

Currently, Vertiv has a PEG ratio of 1.36, a notable contrast to the industry average of 13.52, marking a strong position in terms of growth potential with a Growth Score of A.

PEG Ratio Snapshot

Vertiv Holdings Co. peg-ratio-ttm | Vertiv Holdings Co. Quote

For a complete list of top-ranked stocks, click here.

Stocks That Could Potentially Double

These investments have been carefully selected by a Zacks expert who believes they may see growth of +100% or more in 2024. While past recommendations have yielded impressive returns—ranging from +143.0% to +673.0%—it’s important to remember that not all picks will succeed.

Investors might find these under-the-radar stocks a promising opportunity to enter at an early stage.

To see these five potential winners today, follow this link.

For further insights, download Zacks’ reports on:

The Progressive Corporation (PGR): Free Stock Analysis Report

Interface, Inc. (TILE): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.