Top Buy-Ranked Stocks to Consider on December 2

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, December 2:

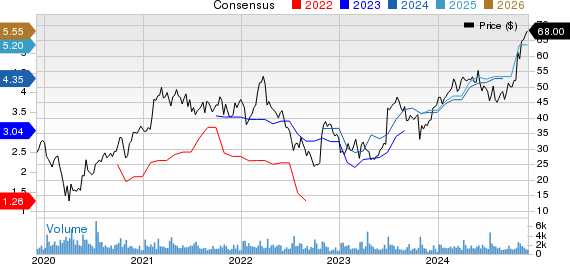

The Greenbrier Companies, Inc. (GBX): This railroad freight car equipment manufacturer holds a Zacks Rank #1. The Zacks Consensus Estimate for its current year earnings has risen 18.2% over the last 60 days.

Price and Consensus for Greenbrier Companies, Inc.

Greenbrier Companies, Inc. price-consensus-chart | Greenbrier Companies, Inc. Quote

Greenbrier has a PEG ratio of 1.98, notably lower than the industry average of 2.53. The company has also earned a Growth Scoreof A.

PEG Ratio (TTM) for Greenbrier Companies, Inc.

Greenbrier Companies, Inc. PEG Ratio (TTM) | Greenbrier Companies, Inc. Quote

LATAM Airlines Group S.A. (LTM): This aviation services provider boasts a Zacks Rank #1, with the Zacks Consensus Estimate for its current year earnings jumping 23.3% over the past 60 days.

Price and Consensus for Lockheed Martin Corporation

Lockheed Martin Corporation price-consensus-chart | Lockheed Martin Corporation Quote

LATAM Airlines has a PEG ratio of 0.65, considerably lower than the industry average of 1.41. The company also holds a Growth Score of B.

PEG Ratio (TTM) for Lockheed Martin Corporation

Lockheed Martin Corporation PEG Ratio (TTM) | Lockheed Martin Corporation Quote

Pitney Bowes Inc. (PBI): This shipping and mailing company, carrying a Zacks Rank #1, has seen the Zacks Consensus Estimate for its current year earnings increase by 8.6% over the last 60 days.

Price and Consensus for Pitney Bowes Inc.

Pitney Bowes Inc. price-consensus-chart | Pitney Bowes Inc. Quote

Pitney Bowes has a PEG ratio of 1.41 compared to the industry average of 3.47. Additionally, it holds a Growth Score of B.

PEG Ratio (TTM) for Pitney Bowes Inc.

Pitney Bowes Inc. PEG Ratio (TTM) | Pitney Bowes Inc. Quote

See the full list of top-ranked stocks here.

Learn more about the Growth Score and how it is calculated here.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry is expected to rebound as tech companies and the economy pivot away from fossil fuels towards renewable energy solutions, particularly for the AI sector.

Trillions of dollars are predicted to be invested in clean energy over the next few years, with solar energy projected to account for 80% of this renewable energy growth. This situation offers significant potential for investors, but selecting the right stocks is crucial.

Discover Zacks’ hottest solar stock recommendation FREE.

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Greenbrier Companies, Inc. (GBX): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.