Looking for investment opportunities? Here are three stocks rated for buy that show notable growth potential as of December 10:

Three Stocks with Promising Growth for Investors

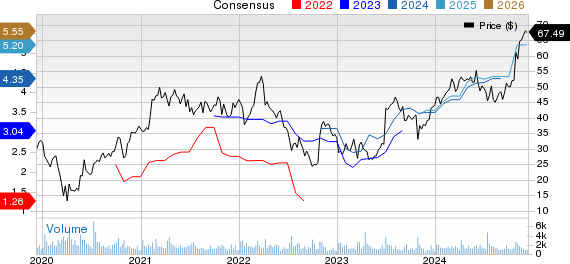

Greenbrier Companies, Inc. (GBX)

Greenbrier Companies, Inc. (GBX): Known for railroad freight car equipment, this company boasts a Zacks Rank of #1. Over the past 60 days, its earnings estimate for the current year has risen by 18.2%.

Greenbrier Companies, Inc. Price and Consensus

Greenbrier Companies, Inc. (The) price-consensus-chart | Greenbrier Companies, Inc. (The) Quote

This company has a PEG ratio of 1.96, better than the industry standard of 2.50. It also has a Growth Score of A.

Greenbrier Companies, Inc. PEG Ratio (TTM)

Greenbrier Companies, Inc. (The) peg-ratio-ttm | Greenbrier Companies, Inc. (The) Quote

LATAM Airlines Group S.A. (LTM)

LATAM Airlines Group S.A. (LTM): This aviation services provider is also rated #1 by Zacks. Its earnings estimate has jumped by 26.4% in the last two months.

LATAM Airlines Group S.A. Price and Consensus

LATAM Airlines Group S.A. price-consensus-chart | LATAM Airlines Group S.A. Quote

With a PEG ratio of 0.67, LATAM Airlines significantly outperforms the industry average of 1.44. The company carries a Growth Score of B.

LATAM Airlines Group S.A. PEG Ratio (TTM)

LATAM Airlines Group S.A. peg-ratio-ttm | LATAM Airlines Group S.A. Quote

Pitney Bowes Inc. (PBI)

Pitney Bowes Inc. (PBI): This mailing and shipping company holds a Zacks Rank of #1 as well. Its current year earnings estimate has increased by 8.6% in the past two months.

Pitney Bowes Inc. Price and Consensus

Pitney Bowes Inc. price-consensus-chart | Pitney Bowes Inc. Quote

Pitney Bowes has a PEG ratio of 1.37, lesser than the industry average of 3.38. This growth-oriented firm carries a Growth Score of B.

Pitney Bowes Inc. PEG Ratio (TTM)

Pitney Bowes Inc. peg-ratio-ttm | Pitney Bowes Inc. Quote

Further Stock Insights

For a comprehensive list of top-rated stocks, check here.

Zacks’ Top 10 Stock Picks for 2025

Interested in early insights on future leading stocks? Historically, Zacks’ selections made between 2012 and November 2024 surged by +2,112.6%, vastly outperforming the S&P 500’s +475.6%. On January 2, Zacks will unveil the next set of top 10 stocks for 2025 after analyzing 4,400 firms.

Be among the first to access these top picks >>

You can also download Zacks’ report on 5 stocks poised to double, available for free today.

Pitney Bowes Inc. (PBI): Free Stock Analysis Report

Greenbrier Companies, Inc. (The) (GBX): Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM): Free Stock Analysis Report

To view the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.