Top Three Growth Stocks to Buy on April 10

Here are three stocks with strong buy ratings and promising growth characteristics for investors to consider today, April 10:

M-tron Industries, Inc. (MPTI)

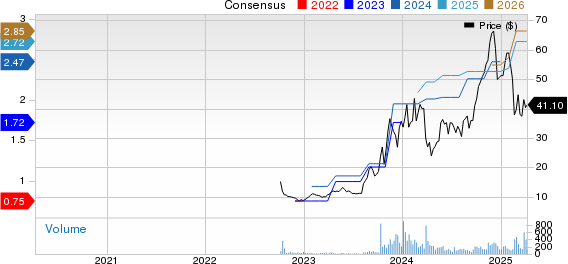

M-tron Industries manufactures frequency and spectrum control products. It holds a Zacks Rank of #1 and has seen the Zacks Consensus Estimate for its current year earnings rise by 13.8% over the past 60 days.

M-tron Industries, Inc. Price and Consensus

M-tron Industries, Inc. price-consensus-chart |

M-tron Industries, Inc. Quote

M-tron Industries has a PEG ratio of 0.54, significantly lower than the industry average of 1.21. Additionally, the company has earned a Growth Score of B.

M-tron Industries, Inc. PEG Ratio (TTM)

M-tron Industries, Inc. peg-ratio-ttm |

M-tron Industries, Inc. Quote

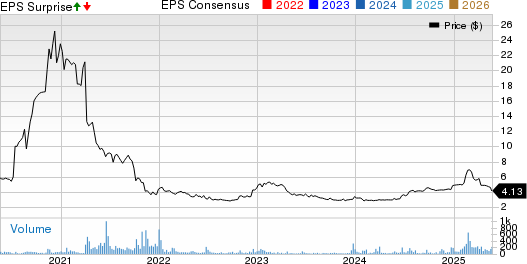

Sterling Infrastructure, Inc. (STRL)

Sterling Infrastructure focuses on e-infrastructure, transportation, and building solutions. It also has a Zacks Rank of #1, with the Zacks Consensus Estimate for its current year earnings increasing by 29.3% in the last 60 days.

Sterling Infrastructure, Inc. Price and Consensus

Sterling Infrastructure, Inc. price-consensus-chart |

Sterling Infrastructure, Inc. Quote

Sterling Infrastructure has a PEG ratio of 0.92, compared to the industry average of 1.21. The company also holds a Growth Score of A.

Sterling Infrastructure, Inc. PEG Ratio (TTM)

Sterling Infrastructure, Inc. peg-ratio-ttm |

Sterling Infrastructure, Inc. Quote

BJ’s Restaurants, Inc. (BJRI)

BJ’s Restaurants operates a chain of casual dining restaurants and carries a Zacks Rank of #1. The Zacks Consensus Estimate for its current year earnings has risen by 13.6% over the past 60 days.

BJ’s Restaurants, Inc. Price and Consensus

BJ’s Restaurants, Inc. price-consensus-chart |

BJ’s Restaurants, Inc. Quote

BJ’s Restaurants has a PEG ratio of 1.28, well below the industry average of 2.05. Furthermore, it has a Growth Score of B.

BJ’s Restaurants, Inc. PEG Ratio (TTM)

BJ’s Restaurants, Inc. peg-ratio-ttm |

BJ’s Restaurants, Inc. Quote

For additional investment opportunities, see the full list of top-ranked stocks here.

To understand how growth scores work, learn more about the Growth score and its calculation here.

5 Stocks Set to Double

Five stocks have been identified by Zacks experts as having the potential to gain +100% or more in 2024. Previous recommendations have achieved returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently flying under Wall Street’s radar, presenting a unique opportunity for early investment.

Today, See These 5 Potential Home Runs >>

For more detailed analyses, check these free stock reports:

BJ’s Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.