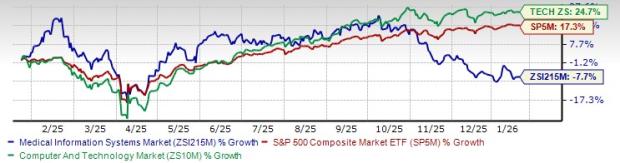

The Zacks Building Products – Heavy Construction industry is currently facing macroeconomic challenges that have led to a subdued earnings outlook, with a Zacks Industry Rank of #188 placing it in the bottom 23% of over 250 Zacks industries. Despite near-term uncertainties related to tariffs, inflation, and labor constraints, there is a compelling long-term outlook driven by a generational U.S. infrastructure push, including transportation upgrades and clean-energy initiatives. The industry’s aggregate earnings estimates for 2026 have decreased slightly to $7.70 per share from $7.73 since November 2025.

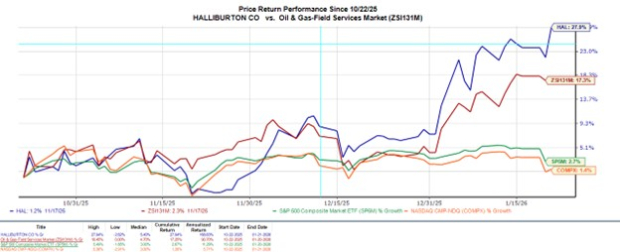

While companies like MasTec, Dycom Industries, Tutor Perini Corporation, and Orion Group Holdings are positioned to benefit significantly from increased demand for infrastructure and renewable energy projects, the industry’s performance has been strong over the past year, with a collective gain of 39% compared to the Zacks Construction sector’s 2.6% rise. Key growth drivers include the booming data center construction and federal initiatives aimed at modernizing infrastructure, which are expected to sustain demand over the coming years.

Overall, while the immediate environment poses challenges, favorable long-term structural trends in heavy construction offer distinct opportunities for established companies with technical expertise and diversified service offerings.