Three Stocks with Strong Buy Ratings for April 2023

Investors may find opportunities in these three stocks, which currently hold a buy rank and exhibit robust momentum characteristics as of April 11th:

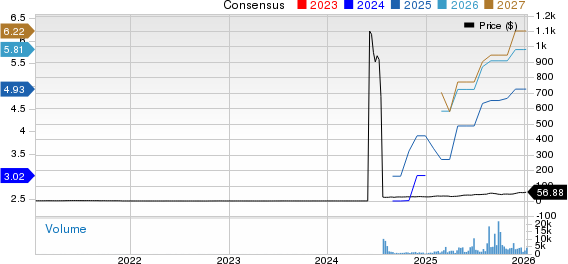

Qifu Technology, Inc. (QFIN): This Credit-Tech platform operates primarily in China, offering a broad range of technology services designed to assist financial institutions and consumers, including SMEs throughout the loan lifecycle. The company has a Zacks Rank of #1 (Strong Buy) and has seen the Zacks Consensus Estimate for its current year earnings rise by 8.3% over the past 60 days.

Qifu Technology, Inc. Price and Consensus

Qifu Technology, Inc. price-consensus-chart | Qifu Technology, Inc. Quote

Qifu Technology’s shares increased by 1.8% over the last three months, outperforming the S&P 500, which experienced a decline of 9.8%. The company boasts a Momentum Score of A.

Qifu Technology, Inc. Price

Qifu Technology, Inc. price | Qifu Technology, Inc. Quote

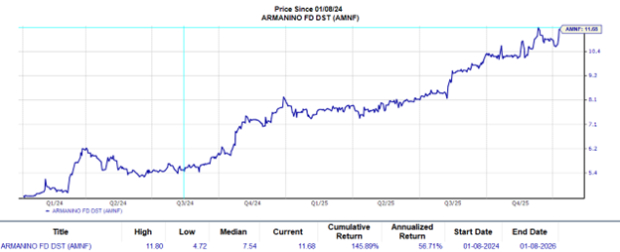

Danone (DANOY): This food processing company primarily operates in France and extends its reach internationally. Danone also enjoys a Zacks Rank of #1 and has seen its current year earnings estimate increase by 6.4% within the last two months.

Danone Price and Consensus

Danone price-consensus-chart | Danone Quote

Danone’s shares soared by 20.4% over the last three months, significantly outpacing the S&P 500’s 9.8% decline. The company has a Momentum Score of A.

Danone Price

Danone price | Danone Quote

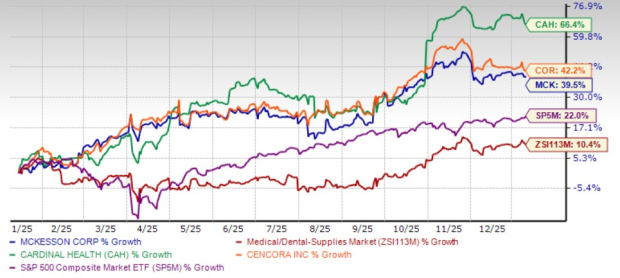

Orange (ORANY): This telecommunications company offers a diverse range of services, including fixed and mobile telephony, data transmission, Internet, multimedia, and other value-added services globally. Orange also holds a Zacks Rank of #1 and has experienced a 3.4% increase in its earnings estimate over the last 60 days.

Orange Price and Consensus

Orange price-consensus-chart | Orange Quote

Orange shares surged 34.3% over the last three months, compared to the S&P 500’s 9.8% drop. The company’s Momentum Score stands at B.

Orange Price

Orange price | Orange Quote

See the full list of top-ranked stocks here.

Learn more about the Momentum score and how it’s calculated here.

Top Semiconductor Stock Recommended by Zacks

This semiconductor stock, just 1/9,000th the size of NVIDIA, has performed dramatically since its recommendation, with NVIDIA itself climbing over +800%. Despite NVIDIA’s continued strength, this new pick is deemed to have significant growth potential.

The company’s robust earnings growth and expanding customer base position it well to meet the rising demands for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is set to grow from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Danone (DANOY) : Free Stock Analysis Report

Qifu Technology, Inc. (QFIN) : Free Stock Analysis Report

Orange (ORANY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.