Three Strong Stocks to Buy This March with Momentum

For investors looking to strengthen their portfolios, here are three stocks with a strong buy ranking and notable momentum characteristics to consider today, March 20th:

Hang Seng Bank (HSNGY)

As one of Hong Kong’s largest listed financial institutions, Hang Seng Bank holds a Zacks Rank #1 (Strong Buy). Over the last 60 days, the Zacks Consensus Estimate for its current year earnings has risen by 5.8%.

Price Performance and Consensus Estimate

Hang Seng Bank Ltd. price-consensus-chart | Hang Seng Bank Ltd. Quote

In the past three months, Hang Seng Bank’s shares have surged by 22%, while the S&P 500 has seen a decline of 4.2%. The stock currently boasts a Momentum Score of A.

Current Price Overview

Hang Seng Bank Ltd. price | Hang Seng Bank Ltd. Quote

Tokio Marine (TKOMY)

This Japan-based holding company is active in non-life insurance, life insurance, and asset management. Tokio Marine also holds a Zacks Rank #1. Over the last 60 days, the Zacks Consensus Estimate for its current year earnings increased by 17.7%.

Price Performance and Consensus Estimate

Tokio Marine Holdings Inc. price-consensus-chart | Tokio Marine Holdings Inc. Quote

In the prior three months, Tokio Marine’s shares increased by 15.4%, outperforming the S&P 500’s loss of 4.3%. The stock carries a Momentum Score of B.

Current Price Overview

Tokio Marine Holdings Inc. price | Tokio Marine Holdings Inc. Quote

First Merchants (FRME)

Operating in the commercial banking sector, First Merchants is also rated Zacks Rank #1. The Zacks Consensus Estimate for its current year earnings increased by 8.5% over the last 60 days.

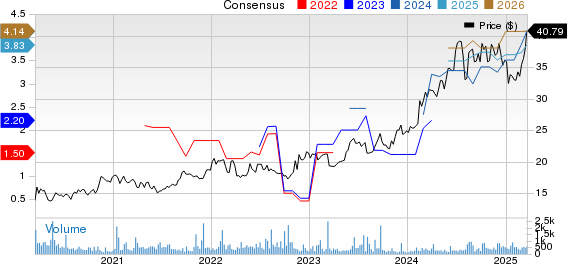

Price Performance and Consensus Estimate

First Merchants Corporation price-consensus-chart | First Merchants Corporation Quote

Over the last three months, shares rose by 0.7%, contrasting with the S&P 500’s 4.3% decline. The company’s Momentum Score is rated B.

Current Price Overview

First Merchants Corporation price | First Merchants Corporation Quote

For more details, see the full list of top ranked stocks here.

Additionally, learn more about the Momentum score and its calculation here.

Zacks Highlights a Top Semiconductor Stock

Identified as only 1/9,000th the size of NVIDIA, which has seen over an 800% increase since being recommended, this new chip stock holds significant potential for growth.

With robust earnings growth and a growing customer base, it is well-positioned to meet the soaring demand stemming from Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is anticipated to expand from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Tokio Marine Holdings Inc. (TKOMY): Free Stock Analysis Report

First Merchants Corporation (FRME): Free Stock Analysis Report

Hang Seng Bank Ltd. (HSNGY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.