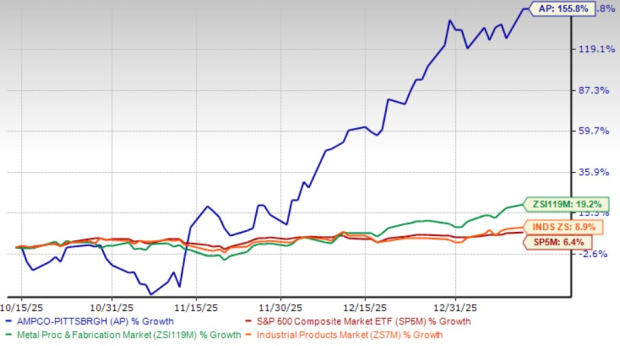

Three Stocks with Strong Momentum and Buy Ratings for Investors

Today, we spotlight three stocks that carry a buy rank along with strong momentum characteristics for investors as of March 11:

Hesai Group (HSAI)

Hesai Group (HSAI) is a leader in LiDAR technology, holding a Zacks Rank #1. The company’s earnings projections have significantly improved, with the Zacks Consensus Estimate for its current year earnings rising by 66.7% over the past 60 days.

Hesai Group Sponsored ADR Price and Consensus

Hesai Group Sponsored ADR price-consensus-chart | Hesai Group Sponsored ADR Quote

Hesai Group’s shares have surged by 44.9% over the last three months, contrasting with the S&P 500’s decline of 7.2%. The company also boasts a Momentum Score of B.

Hesai Group Sponsored ADR Price

Hesai Group Sponsored ADR price | Hesai Group Sponsored ADR Quote

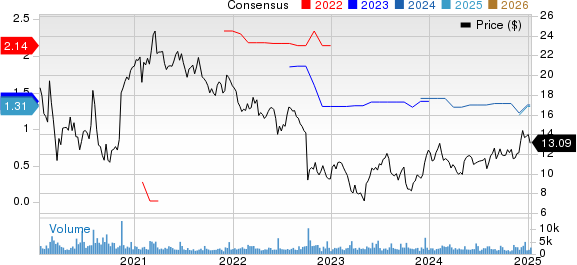

ESCO Technologies Inc. (ESE)

ESCO Technologies Inc. (ESE), an engineered filtration and fluid control firm, also holds a Zacks Rank #1. The latest Zacks Consensus Estimate for its earnings has risen by 18.8% in the last 60 days.

ESCO Technologies Inc. Price and Consensus

ESCO Technologies Inc. price-consensus-chart | ESCO Technologies Inc. Quote

ESCO Technologies’ shares increased by 9.9% in the last three months, as compared to the S&P 500’s loss of 7.2%. The company maintains a Momentum Score of B.

ESCO Technologies Inc. Price

ESCO Technologies Inc. price | ESCO Technologies Inc. Quote

The Bank of New York Mellon Corporation (BK)

The Bank of New York Mellon Corporation (BK), a provider of financial products and services, has a Zacks Rank #1. Its earnings estimate has grown by 5% over the past 60 days.

The Bank of New York Mellon Corporation Price and Consensus

The Bank of New York Mellon Corporation price-consensus-chart | The Bank of New York Mellon Corporation Quote

The Bank of New York Mellon Corporation’s shares rose by 6.5% in the past three months, while the S&P 500 faced a 7.2% decline. The company has a Momentum Score of B.

The Bank of New York Mellon Corporation Price

The Bank of New York Mellon Corporation price | The Bank of New York Mellon Corporation Quote

For further opportunities, see the full list of top-ranked stocks here.

To learn more about the Momentum score and its calculation, follow this link.

Zacks’ Research Chief Identifies High-Potential Stock

Our team has revealed stocks with a high probability of gaining 100% or more soon. Among these picks, Director of Research Sheraz Mian identifies one stock positioned for the most significant growth.

This selection is part of a leading financial firm boasting a rapidly expanding customer base of over 50 million and innovative solutions that signal substantial potential for gains. Though our handpicked stocks can vary in success, this one could outperform previous Zacks’ Stocks Set to Double, like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

The Bank of New York Mellon Corporation (BK): Free Stock Analysis Report

ESCO Technologies Inc. (ESE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.