Investors Eye Three Stocks with Strong Buy Ratings

On March 27th, investors may want to examine three stocks that currently hold a buy rank and exhibit robust momentum characteristics.

AerSale Corporation (ASLE)

AerSale Corporation is a provider of aftermarket commercial aircraft, engines, and parts. It is currently rated Zacks Rank #1. Over the past 60 days, the Zacks Consensus Estimate for its current year earnings has surged by 62.5%.

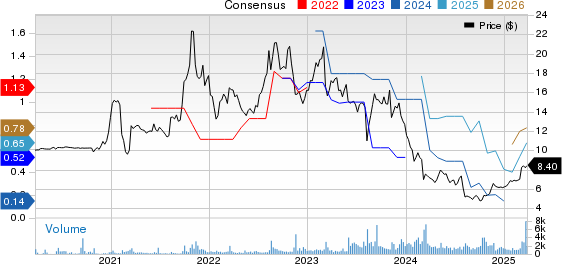

AerSale Corporation Price and Consensus

AerSale Corporation price-consensus-chart | AerSale Corporation Quote

In the last three months, AerSale’s shares have appreciated by 36.6%, contrasting sharply with the S&P 500, which declined by 3.3%. The company holds a Momentum Score of A.

AerSale Corporation Price

AerSale Corporation price | AerSale Corporation Quote

Enterprise Financial Services Corporation (EFSC)

Enterprise Financial Services Corp is a financial holding company for Enterprise Bank & Trust. It also holds a Zacks Rank #1, with the Zacks Consensus Estimate for its current year earnings increasing 8.1% within the last two months.

Enterprise Financial Services Corporation Price and Consensus

Enterprise Financial Services Corporation price-consensus-chart | Enterprise Financial Services Corporation Quote

The shares of Enterprise Financial have increased by 8.5% over the past half-year, outperforming the S&P 500’s decline of 0.9%. The company possesses a Momentum Score of B.

Enterprise Financial Services Corporation Price

Enterprise Financial Services Corporation price | Enterprise Financial Services Corporation Quote

1st Source Corporation (SRCE)

1st Source Corporation serves as a bank holding company for 1st Source Bank. It carries a Zacks Rank #1 and has seen its current year earnings estimate rise nearly 7.8% over the past two months.

1st Source Corporation Price and Consensus

1st Source Corporation price-consensus-chart | 1st Source Corporation Quote

Over the last three months, shares of 1st Source increased by 4.8%, while the S&P 500 declined by 3.3%. The company possesses a Momentum Score of B.

1st Source Corporation Price

1st Source Corporation price | 1st Source Corporation Quote

For a comprehensive list of top-ranked stocks, see the full list of top ranked stocks here.

For further details, learn more about the Momentum score and how it is calculated here.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we offered our members access to all our stock picks for just $1 for 30 days. There are no further obligations.

Many have seized this opportunity while others hesitated, thinking there might be a catch. We aim to familiarize you with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which have yielded 256 positions with double- and triple-digit gains in 2024 alone.

Enterprise Financial Services Corporation (EFSC): Free Stock Analysis Report

1st Source Corporation (SRCE): Free Stock Analysis Report

AerSale Corporation (ASLE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.