Three Top Stocks to Consider with Strong Momentum

Investors looking for promising stocks should consider these three options identified on March 13, all showing a buy rank and strong momentum:

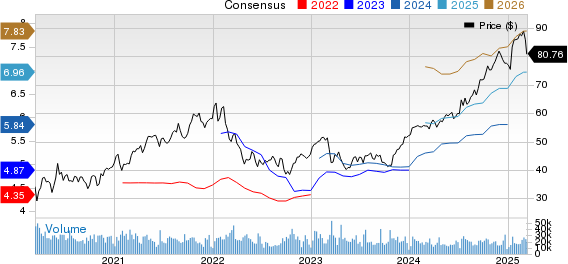

The Bank of New York Mellon Corporation (BK)

This financial services provider holds a Zacks Rank of #1, and its consensus earnings estimate for the current year has increased by 5.3% over the past 60 days.

Price Performance and Consensus

The Bank of New York Mellon Corporation price-consensus-chart | The Bank of New York Mellon Corporation Quote

The Bank of New York Mellon Corporation’s shares rose by 2.7% over the previous three months, while the S&P 500 experienced a decline of 7.9%. This company has a Momentum Score of A.

Stock Price

The Bank of New York Mellon Corporation price | The Bank of New York Mellon Corporation Quote

Tokio Marine Holdings, Inc. (TKOMY)

This insurance giant also has a Zacks Rank of #1, with its current year earnings estimate rising by 17.7% over the last two months.

Price Performance and Consensus

Tokio Marine Holdings Inc. price-consensus-chart | Tokio Marine Holdings Inc. Quote

Tokio Marine’s shares increased by 2.4% over the past three months, contrasting with the S&P 500’s 7.9% decline. The company enjoys a Momentum Score of A.

Stock Price

Tokio Marine Holdings Inc. price | Tokio Marine Holdings Inc. Quote

908 Devices Inc. (MASS)

This commercial-stage technology firm carries a Zacks Rank of #1, with its earnings estimate for the current year improving by 7.7% during the last 60 days.

Price Performance and Consensus

908 Devices Inc. price-consensus-chart | 908 Devices Inc. Quote

Shares of 908 Devices surged by 107.4% over the past three months, while the S&P 500 dropped by 7.9%. The company maintains a Momentum Score of A.

Stock Price

908 Devices Inc. price | 908 Devices Inc. Quote

For more options, check out the complete list of top-ranked stocks here.

You can also learn about the Momentum score and its calculation here.

7 Best Stocks for the Next 30 Days

Experts have just released a list of seven elite stocks from a pool of 220 Zacks Rank #1 Strong Buys. These stocks are deemed “Most Likely for Early Price Pops.”

Since 1988, this comprehensive list has outperformed the market more than twice, with an average annual gain of +24.3%. It is advisable to pay close attention to these selected stocks.

Bank of New York Mellon Corporation (BK): Free Stock Analysis Report

Tokio Marine Holdings Inc. (TKOMY): Free Stock Analysis Report

908 Devices Inc. (MASS): Free Stock Analysis Report

This article was originally published by Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.