Assessing Amazon: An Investment Opportunity Amid Market Challenges

As of market close on April 7, the Nasdaq Composite has fallen by 19% so far this year, entering bear market territory. Among the stocks affected, the “Magnificent Seven” have all posted negative returns this year. In times of volatility, it can be challenging for investors to remain objective. Much of the ongoing sell-off seems driven by emotion rather than sound logic. While concerns about uncertainty are valid, I believe some stock prices, including Amazon’s, have declined excessively.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Amazon’s Current Valuation: A Look at the Numbers

Analyzing Amazon’s value can be complex for several reasons. For one, Amazon’s net income varies significantly from quarter to quarter. This fluctuation is largely due to seasonal trends in its core e-commerce operations and broader economic factors such as inflation and interest rates, affecting both consumers and businesses. Moreover, net income doesn’t accurately reflect Amazon’s overall profitability given the accounting principles involved.

Additionally, the price-to-sales (P/S) ratio isn’t particularly useful in valuing Amazon due to its vast range of operations. The business includes various sectors such as streaming, advertising, artificial intelligence (AI), grocery delivery, and cloud computing, which makes it difficult to find suitable comparable companies for benchmarking.

Thus, I prefer evaluating Amazon based on its cash flow and comparing its performance to itself over time.

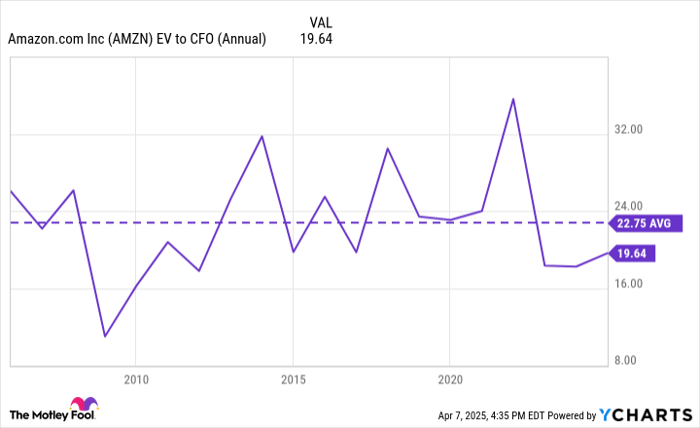

AMZN EV to CFO (Annual) data by YCharts. EV = enterprise value. CFO = cash flow from operations.

The chart above demonstrates Amazon’s enterprise value to cash flow from operations (EV/CFO) over the past 20 years. Currently, the EV/CFO of 19.6 indicates that Amazon is trading at a discount compared to its long-term average of 22.7. Additionally, it is notable how the company’s EV/CFO has compressed over recent years.

Historically, Amazon last traded at an EV/CFO close to 20 sometime after 2010, suggesting that the stock is now at its lowest valuations in over a decade, based on operational cash flow.

Image Source: Getty Images.

Market Dynamics: Buying the Dip

President Donald Trump’s new tariff policies currently influence the Nasdaq sell-off. While the implications of these tariffs are uncertain, they contribute to concerns about how they may affect multinational companies like Amazon. However, I believe these fears may be exaggerated. Tariffs could potentially raise prices on certain goods and services, but I argue that traditional brick-and-mortar retailers will bear a more significant burden, whereas Amazon may benefit from these challenges, enhancing its appeal to consumers looking for competitive pricing.

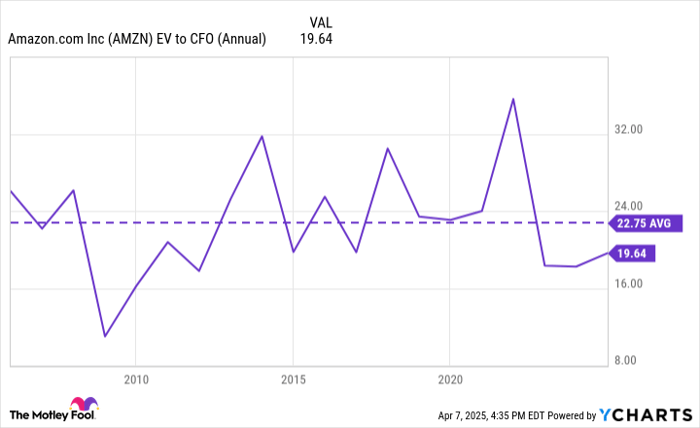

The trends shown in the chart below highlight that, despite economic recessions (indicated by grey columns), Amazon has consistently generated stable cash flow over the past two decades.

AMZN Cash from Operations (Annual) data by YCharts.

This consistent profitability has enabled Amazon to expand beyond its foundational e-commerce business. It’s surprising that investors have not recognized Amazon’s transformation from a simple online retailer 20 years ago to a diversified giant today.

I believe Amazon is currently undervalued and remains well-positioned despite ongoing economic volatility. At this moment, it represents a strong buying opportunity for long-term investors.

Catch This Second Chance for a Profitable Investment

If you’ve ever felt like you missed investing in high-performing stocks, you’ll want to pay attention to this. Occasionally, our expert analysts issue a “Double Down” Stock recommendation for companies poised for growth. If you’re concerned you’ve already missed the chance to invest, now is an optimal time to make a move.

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $249,730!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $32,689!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $469,399!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come again soon.

Continue »

*Stock Advisor returns as of April 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.