The case for silver

In December 2023, Natural Resources Canada embarked on a journey to review Canada’s Critical Minerals list and methodology, inviting public commentary. One criterion highlighted the imperative role of the mineral in propelling the nation towards a low carbon and digital economy. Silver, revered as the ultimate electrical and thermal conductor, along with its unrivaled reflective properties, is heralded as indispensable for various industrial and technological applications. The surge in demand for technologies such as solar power has fueled a corresponding increase in industrial demand for silver.

Global demand and industrial applications

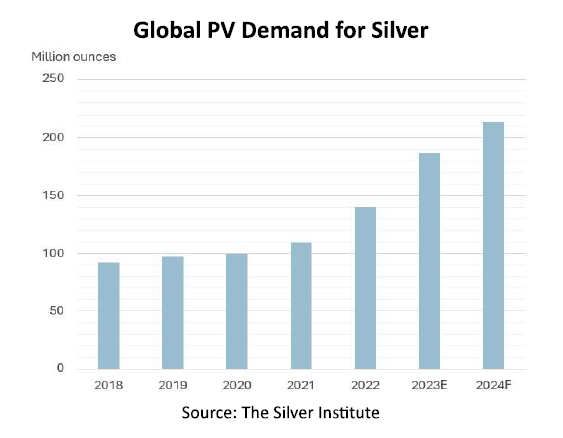

In 2023, global silver demand stood at a staggering 1,167 million ounces (Moz), with industrial use accounting for an impressive 50%. The burgeoning solar power sector gobbled up 161.1 Moz of silver, constituting 14% of the global demand.

Moreover, silver is a prevalent component of nuclear reactors. With Canada committing to tripling nuclear energy capacity by 2050, the demand for silver in the nuclear sphere is poised to soar. The burgeoning shift towards electrification in the automotive industry, especially in electric vehicles and hybrids, is set to propel the demand for silver in electric contacts and connectors.

Addressing misconceptions

The collective missive from mining CEOs underlined a widespread misconception about silver’s availability as the primary reason behind its exclusion as a critical mineral. They emphatically affirmed that global researchers had expressed concerns over supply limitations, disruptions, competition from other industries, and mounting demand, which could potentially bottleneck the transition to a low-carbon economy.

Engagement with regulatory authorities

Jillian Lennartz, ESG director at First Majestic Silver, revealed that queries about the U.S. Geological Survey’s methodology had been lodged with a House of Representatives subcommittee. While voicing reservations about the exclusion of silver from the critical minerals list, there were direct dialogues with the Department of Energy (DOE). The DOE admitted that silver was not quantitatively assessed based on their methodology and requested a written submission of concerns for review.

The National Mining Association and the Silver Institute jointly communicated their concerns to the DOE, contending that the proven or probable silver reserves fell short of projected demand, with silver recycling failing to offer a substantial material stream.

Expectations for future developments

An official at the USGS acknowledged that all minerals under consideration for the 2025 list were undergoing meticulous evaluation based on set criteria, with the list and methodology slated for release in the federal register later this year.