Market Uncertainty: Time to Consider Quality-Focused ETFs

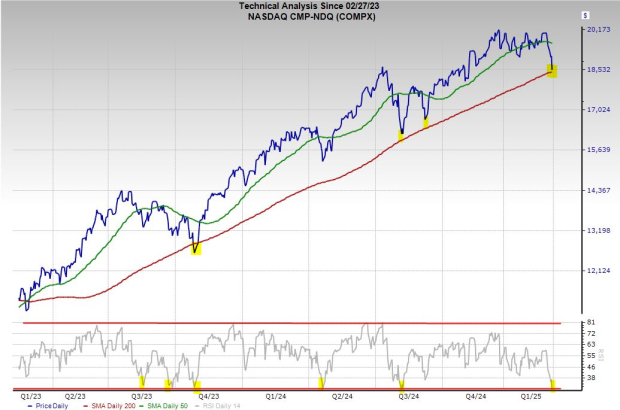

The stock market is currently volatile, with abrupt growth phases quickly followed by price declines. Overall consumer confidence remains low, raising questions about the sustainability of the bull market that began in October 2022. Investors now ponder how far the surge from artificial intelligence (AI) can elevate major market indices.

While a market collapse is not imminent, predicting the future is inherently uncertain. Historically, the stock market trends upward in the long term, despite encountering various obstacles. For those contemplating a $2,000 investment (or any reasonable sum), an exchange-traded fund (ETF) focused on high-quality companies could be a solid choice.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider. Learn More »

Image source: Getty Images.

Evaluating Simple ETFs in a Jittery Market

Investors often look to leading index funds when considering where to allocate funds. The S&P 500 (SNPINDEX: ^GSPC) consists of about 500 carefully selected American stocks known for their large market capitalizations and strong financial performances. The Dow Jones Industrial Average (DJINDICES: ^DJI) is even more selective, showcasing just 30 industrial giants chosen by an expert panel, excluding transportation and utility firms. Consequently, index funds such as the Vanguard S&P 500 ETF (NYSEMKT: VOO) or SPDR Dow Jones Industrial Average ETF (NYSEMKT: DIA) remain strong investment options during economic uncertainty.

However, if you believe that reliance on a few high-performing stocks is a risk—especially with the S&P 500 currently influenced heavily by tech—there are alternatives. As of now, eight of the top ten S&P 500 holdings come from the tech industry, with about 60% of the Dow’s total value stemming from technology, finance, and healthcare sectors.

Enter the iShares MSCI USA Quality Factor ETF (NYSEMKT: QUAL), a substantial fund with a notable track record that could serve as an excellent investment in these unpredictable times.

The Quality Factor ETF: A Strong Contender

The Quality Factor ETF has been operational since 2013 and manages an impressive $50 billion in assets. Despite its passive index tracking nature and a low expense ratio of just 0.15%, it remains less popular than traditional Dow and S&P 500 ETFs.

This fund tracks the MSCI USA Sector Neutral Quality Index, which showcases large and mid-cap American stocks that meet specific quality criteria. Stocks are evaluated based on three key factors:

- Return on equity, indicating profitability relative to assets

- Debt to equity, assessing the balance between financial obligations and shareholder equity

- Earnings variability, rewarding predictability in earnings performance

An ideal company under this assessment features high return on equity, low debt to equity, and stable profits—the essential qualities of what you invest in here.

The quality factor score is multiplied by market cap, establishing the index’s weighting. A 5% cap prevents any single stock from dominating the index significantly. This index is adjusted biannually to reflect recent scores and reset caps.

The latest adjustment occurred on January 31. While many top constituents mirror those in the Dow and S&P 500, there are notable differences. For instance, the Quality Factor ETF includes smaller allocations for high-profile companies like Amazon (NASDAQ: AMZN) and Tesla (NASDAQ: TSLA), while it features greater proportions of TJX Companies (NYSE: TJX) and Visa (NYSE: V).

Solid Performance and Robust Returns

The Quality Factor ETF has demonstrated strong performance. Over time, its returns closely align with those of S&P 500 index funds:

QUAL Total Return Level data by YCharts

Although it may seem unnecessary to choose this fund over the Vanguard S&P 500 ETF due to their similar historical performance, several factors should be noted:

- Matching the performance of a leading market indicator for over a decade is an accomplishment and demonstrates solid wealth-building potential for shareholders.

- Past performance is not an assurance of future success. This is particularly pertinent during volatile market conditions. Focusing your investments on around 120 of the most financially stable stocks from the S&P 500 may offer reassurance if market conditions fluctuate.

Sticking with established index funds like the S&P 500 may offer stability; however, favoring a quality-centric portfolio could be advantageous now. If you have an extra $2,000 available for investment, considering acquiring 11 shares of the iShares MSCI USA Quality Factor ETF would be wise.

Though its name may not be catchy, this ETF is a reliable investment option for uncertain market times.

A Second Chance at Potentially High Returns

Do you feel as though you missed out on investing in top stocks? Take note of this opportunity.

Occasionally, our expert analyst team identifies a “Double Down” stock—a recommendation for companies that they believe are poised for significant growth. If you think you’ve missed your opportunity, now is an ideal moment to invest before it’s too late. The results speak volumes:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $311,551!*

- Apple: A $1,000 investment when we doubled down in 2008 would now represent $44,990!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now amount to $519,375!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not arise again soon.

Continue »

*Stock Advisor returns as of February 28, 2025

John Mackey, the former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, also holds a position on The Motley Fool’s board. Anders Bylund has investments in Alphabet, Amazon, and Vanguard S&P 500 ETF. The Motley Fool owns and recommends Alphabet, Amazon, TJX Companies, Tesla, Vanguard S&P 500 ETF, and Visa. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.