Adyen: A Strong Contender in the Payments Industry

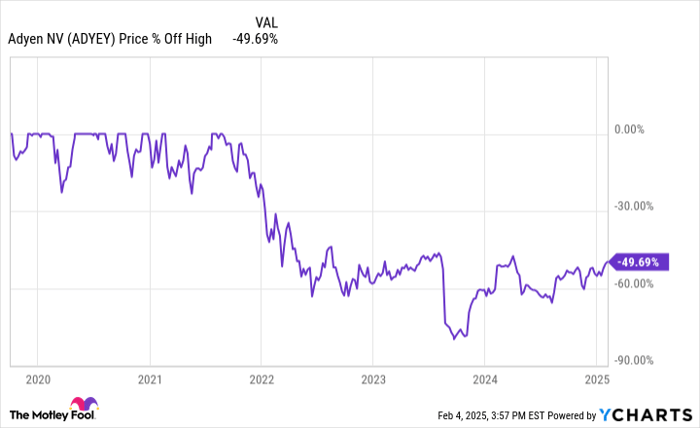

Adyen (OTC: ADYE.Y) experienced remarkable growth during the peak of the COVID-19 pandemic. However, like other companies that thrived during this time, Adyen faced challenges in 2022 and 2023, causing its stock to drop as much as 75% from its record highs. Although shares have regained some value, they remain approximately 50% lower than peak levels in early February.

In contrast to other companies that are losing their advantages, Adyen’s operations are thriving today and are expected to continue growing in the years ahead. Let’s explore why investing in this financial technology leader might be a sound decision before its upcoming fourth-quarter earnings report on February 13.

Building Competitive Strength and Scale

The payments industry can be complex, involving multiple services that authorize and complete each transaction when you swipe your card or pay online.

Adyen’s founders aimed to simplify this by developing a vertically integrated payments processor. Today, it stands among the largest players in the market. With a fully integrated platform designed for modern online transactions, Adyen boasts a significantly higher success rate than its competitors, fostering customer satisfaction and loyalty.

Initially focusing on online payments in Europe, Adyen has expanded globally and covers nearly every category of payment processing. It aims to serve as a comprehensive solution for its partners, often large platforms like Spotify and Uber. The payments process for services like Uber is largely seamless, demonstrating the effectiveness of Adyen’s advanced processing software.

Adyen’s competitive edge began with its state-of-the-art technology, but it stands to gain further advantages as it scales. This scaling allows Adyen to reduce its pricing compared to upstart competitors. For context, Adyen’s annual payment volume was below $35 billion in 2015. By 2023, this volume exceeded $1 trillion. As it continues to grow, the company can offer lower prices while sustaining high profit margins, a benefit of its fixed cost structure.

Increasing Margins and Gaining Market Share

Adyen’s disciplined corporate culture is another appealing aspect. Its headquarters, located outside of Silicon Valley, contributes to its prudent cost management compared to other technology companies. This approach enabled Adyen to achieve an EBITDA (earnings before interest, taxes, depreciation, and amortization) margin exceeding 50% during the pandemic surge.

However, during the technology sector’s decline in 2022, Adyen’s profit margins fell. This decline was not primarily due to diminishing pandemic-related growth, but rather Adyen’s decision to expand its workforce while other firms implemented layoffs or hiring freezes. This strategic move, aimed at preparing for global growth, temporarily reduced the EBITDA margin, although it has begun to recover, reaching 46% in the first half of 2024 compared to the same period in 2023.

These initiatives, made during a market downturn, have positioned Adyen to capture market share from its competitors. While processing a trillion dollars in payments annually is impressive, Adyen is still a minor player in the vast digital payments market. A significant opportunity remains for the company to expand.

ADYEY data by YCharts.

Long-Term Prospects for Adyen

Adyen operates on a model that generates revenue by taking a small percentage from each transaction. This means the company’s income will increase alongside the growth in payment volumes. Management has projected at least 20% annual revenue growth through 2026, and I believe that double-digit growth will persist beyond that as annual payment volumes reach $2 trillion, $3 trillion, and more. The global transition to digital payments, coupled with inflation, broadens the total addressable market each year.

In the last year, Adyen reported just over $2 billion in revenue. I believe the company has the potential to double that figure to $4 billion in only a few years and possibly reach $10 billion later on, given the extensive nature of the payments processing sector. With long-term guidance for EBITDA margins of 50%, Adyen could achieve $5 billion in EBITDA in the future. Considering its current market cap of around $50 billion, Adyen appears to be a growth stock with a stable outlook.

Now is an opportune moment to consider purchasing Adyen stock ahead of its Q4 earnings announcement on February 13. A long-term investment could be beneficial.

A Second Chance at a Potentially Rewarding Opportunity

If you ever felt you missed out on investing in highly successful stocks, here’s your chance.

On rare occasions, our team of expert analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re worried you’ve missed your opportunity to invest, now may be the ideal time to act, as the numbers support this:

- Nvidia: An investment of $1,000 made when we doubled down in 2009 would have grown to $336,677!*

- Apple: Investing $1,000 in 2008 would now be worth $43,109!*

- Netflix: A $1,000 investment in 2004 would have soared to $546,804!*

We are currently issuing “Double Down” alerts for three outstanding companies, presenting a rare investment opportunity.

Learn more »

*Stock Advisor returns as of February 3, 2025

Brett Schafer has positions in Spotify Technology. The Motley Fool has positions in and recommends Adyen, Spotify Technology, and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.