Leidos Holdings, Inc. (LDOS) has gained attention in the Zacks Aerospace Defense industry due to its increasing earnings estimates, impressive return on equity (ROE), and a solid backlog, making it a compelling investment choice.

Let’s explore why this Zacks Rank #2 (Buy) stock is a favorable option currently.

Growth Projections & Earnings Performance

The Zacks Consensus Estimate for Leidos’ 2025 earnings per share (EPS) recently rose by 1.2% to $10.44 over the past two months. The company also projects total revenues of $17.09 billion for 2025, reflecting a 2.6% increase from the reported figures in 2024.

Over a long-term horizon of three to five years, Leidos anticipates an earnings growth rate of 7.4%. Additionally, it has achieved an average earnings surprise of 28.34% within the last four quarters.

Strong Return on Equity

Return on equity (ROE) is a measure of how effectively a company uses its funds to generate profits. Currently, Leidos boasts an ROE of 30.93%, significantly higher than the industry average of 9.53%. This suggests that Leidos is leveraging its assets more efficiently than many competitors.

Debt Management

Leidos maintains a total debt to capital ratio of 50.03%, which is more favorable than the industry average of 55%. In the fourth quarter of 2024, the company reported a times interest earned (TIE) ratio of 9.5, indicating robust capability to meet its interest payment obligations.

Liquidity Position

As of the end of the fourth quarter of 2024, Leidos reported a current ratio of 1.21. This figure, greater than 1, demonstrates the company’s capacity to fulfill its short-term liabilities comfortably.

Growing Backlog

Leidos secures significant revenues from contracts with the Pentagon and other U.S. allies, particularly for its cost-effective military technologies. This strategy has led to a substantial backlog of $43.6 billion as of January 3, 2025, a notable increase from $37 billion the previous year. Such a backlog is crucial as it enhances future revenue potential.

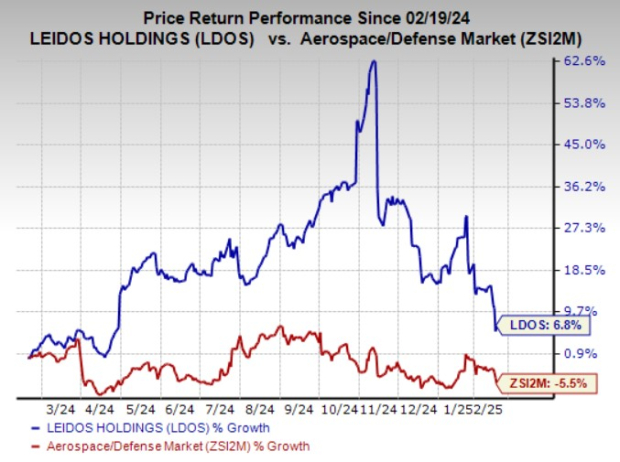

Stock Performance Overview

Over the past year, LDOS shares have climbed 6.8%, contrasting with a decline of 5.5% in the broader industry.

Image Source: Zacks Investment Research

Other Stocks Worth Watching

Several other high-ranking stocks in the Aerospace Defense sector include Kratos Defense & Security Solutions, Inc. (KTOS), RTX Corporation (RTX), and FTAI Aviation Ltd. (FTAI), all currently rated Zacks Rank #2 (Buy). You can find the complete list of Zacks #1 Rank (Strong Buy) stocks available here.

KTOS has delivered an outstanding average earnings surprise of 70.63% over its last four quarters. The 2025 total revenue estimate for KTOS stands at $1.28 billion, highlighting a growth projection of 12.2% from 2024 figures.

Meanwhile, RTX aims for a long-term earnings growth rate of 9.7% with a 2025 sales projection of $84.28 billion, implying a 4.4% increase from the previous year. Finally, FTAI has achieved an average earnings surprise of 30.65% in the past four quarters, with its 2025 revenue estimate at $2.06 billion, reflecting a growth of 20.2% from 2024.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss out on our 10 top stock picks for 2025—handpicked by Zacks Director of Research Sheraz Mian. This portfolio has shown remarkable success, gaining +2,112.6% since inception in 2012, far surpassing the S&P 500’s +475.6%. Discover the stocks with significant growth potential for the coming year.

Want the latest recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free now.

Kratos Defense & Security Solutions, Inc. (KTOS): Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS): Free Stock Analysis Report

FTAI Aviation Ltd. (FTAI): Free Stock Analysis Report

RTX Corporation (RTX): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.