DuPont Reports Mixed Performance Amid Acquisitions and Cost Pressures

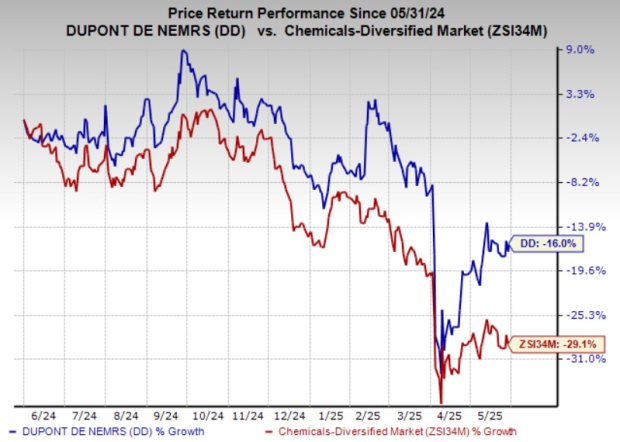

DuPont de Nemours, Inc. (DD) benefits from investments in innovation, productivity measures, and acquisitions like Spectrum Plastics Group and Donatelle Plastics, despite challenges from weak industrial demand and high separation costs. In the past year, DD shares have declined 16%, outperforming the Chemicals Diversified industry, which fell by 29.1%.

Acquisitions and Innovations Drive Growth

DuPont focuses on growth through innovation and product development. The company’s investments target high-growth sectors, particularly in healthcare. Acquiring Spectrum Plastics, a top manufacturer of medical devices, enhances DuPont’s position in stable health markets.

The purchase of Donatelle Plastics further boosts DuPont’s healthcare segment, adding advanced technologies like device assembly and precision machining. DuPont is leveraging productivity improvements and cost synergies, with structural cost actions expected to take effect by 2025.

DuPont continues to raise prices in response to inflation, which should improve results. The company also aims for annualized cost savings of $150 million through ongoing restructuring efforts. It achieved a transaction-adjusted free cash flow conversion of 105% in 2024 and plans to increase dividends by 8% to 41 cents per share in February 2025.

Market Weakness and Cost Challenges

Sales in DuPont’s IndustrialCo segment are suffering due to difficulties in the construction market. Ongoing uncertainties in the U.S. housing market, combined with rising borrowing costs and inflation, are hindering growth. The construction and automotive sectors are showing weakness, with sluggish automotive build rates in North America and Europe impacting sales.

Additionally, costs from the separation of the electronics business, set to complete by November 1, 2025, are expected to reach nearly $700 million, primarily affecting 2025 performance. Consequently, DuPont anticipates free cash flow conversion to drop below 90% in 2025, compared to 2024 performance.

The company also faces pricing pressure, as overall volume growth was met with lower prices in the last quarter. This trend may persist into the following quarter, potentially squeezing margins further.

Current Zacks Rank and Competitors

DuPont currently holds a Zacks Rank of #3 (Hold). Competing stocks in the Basic Materials sector include Carpenter Technology Corporation (CRS), Newmont Corporation (NEM), and Hawkins, Inc. (HWKN), with CRS and NEM rated #1 (Strong Buy) and HWKN rated #2 (Buy).

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal year earnings is $7.27, anticipating a year-over-year increase of 43.4%. Newmont’s earnings estimate for the year stands at $4.18, reflecting a 20.1% rise, while Hawkins is expected to report earnings of $4.37, an 8.4% increase.