Wingstop Inc. WING stands poised for growth through increased sales, restaurant openings, and new technology. Strategic partnerships are promising for the company, but rising costs present challenges.

Wingstop’s Recipe for Growth

Wingstop has seen remarkable success, with domestic same-store sales up 20.9% year over year in the third quarter of 2024. This performance highlights strong customer loyalty and increasing transaction volumes. Notably, the Average Unit Volume has risen to $2.1 million, compared to $2 million in the prior quarter and $1.8 million a year ago.

A significant contributor to Wingstop’s strong performance is its effective unit economics. With an average cost of around $500,000 to open a new location, the company enjoys unlevered cash-on-cash returns exceeding 70%. This attractive financial model continues to attract franchisees, resulting in over 100 new restaurant openings during the third quarter. Looking ahead, Wingstop plans to open between 320 and 330 new restaurants in financial year 2024.

The company’s investment in technology also plays a crucial role in its success. Earlier this year, Wingstop introduced its proprietary tech platform, MyWingstop, which integrates over $2.5 billion in digital sales. This system not only provides franchisees with valuable data and operational tools but also enhances customer experience through AI-driven personalization. Since its launch, order efficiency has improved by 10%, the first-party database has expanded by 35%, and digital sales now represent 69% of total sales, illustrating the platform’s impact.

Moreover, Wingstop has significantly boosted its brand visibility through high-profile partnerships, including becoming the official chicken partner of the NBA. Collaborations with the NFL and NBA have expanded the company’s reach, helping it attract new customers and achieve record guest acquisition. These strategic media investments have strengthened Wingstop’s position in the live sports and streaming markets, further driving engagement and sales.

Challenges Facing Wingstop

Image Source: Zacks Investment Research

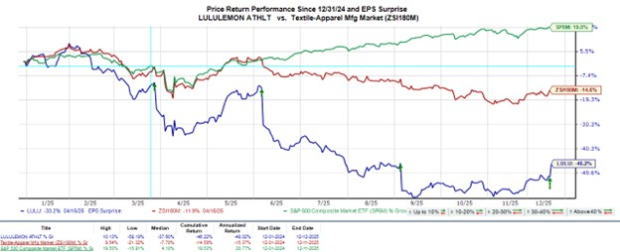

Despite its recent successes, Wingstop’s stock has dropped 30.1% in the last three months, while the restaurant industry declined by only 0.7%. This downturn is largely attributed to broader economic challenges.

The company is also dealing with rising expenses. Selling, general and administrative (SG&A) costs have climbed by $9.2 million year over year, reaching a total of $32.3 million in the third quarter. This increase reflects more performance-based stock compensation and higher headcount to fuel growth. Although these expenditures aim to enhance scalability, unexpectedly high costs could pressure profit margins if sales growth slows. The new SG&A guidance for 2024 has been adjusted to between $117.5 million and $118.5 million, up from earlier projections of $114 million to $116 million.

Wingstop’s Investment Standing and Notable Comparisons

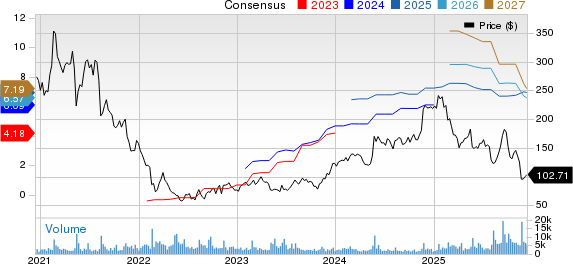

Currently, Wingstop holds a Zacks Rank #3 (Hold). Here are some stocks within the Zacks Retail-Wholesale sector that are performing better:

Brinker International, Inc. EAT boasts a Zacks Rank #1 (Strong Buy), with a trailing four-quarter earnings surprise averaging 12.1%. EAT has experienced a significant stock surge of 84.1% over the last six months. The consensus forecast for EAT indicates fiscal 2025 sales and earnings per share (EPS) growth of 9.3% and 44.2%, respectively.

Sprouts Farmers Market, Inc. SFM also holds a Zacks Rank of 1, recording a trailing four-quarter earnings surprise of 15.3% on average and a 59.8% increase in its stock over the past six months. The consensus suggests a sales and EPS rise of 10% and 14.4%, respectively, for fiscal year 2025.

Deckers Outdoor Corporation DECK maintains a Zacks Rank #2 (Buy) and has gained 25.8% over the last half year, with an average trailing four-quarter earnings surprise of 41.1%. Analysts expect DECK’s sales and EPS to grow by 13.6% and 13%, respectively, in fiscal year 2025.

Zacks Highlights Top 10 Stocks for 2025

Are you interested in early access to our top 10 stock picks for 2025?

Historical performance suggests these selections could be exceptional.

Since 2012, when our Director of Research Sheraz Mian took over the portfolio, the Zacks Top 10 Stocks have achieved a remarkable +2,112.6%, greatly outperforming the S&P 500’s +475.6%. Now, Sheraz is reviewing 4,400 companies to identify the best 10 stocks for 2025. Don’t miss this opportunity to access these picks, available starting January 2.

Get Early Access to New Top 10 Stocks >>

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.