The Resilient Rise of the S&P 500: A 2024 Recap

The S&P 500 has continued to soar into 2024, impressively building on last year’s performance with a total return of 25%. This marks the beginning of the third year in its current bullish trend, despite being regarded as one of the most disliked market rallies.

Shifting Market Dynamics and Emerging Trends

The challenges that once hampered market growth two years ago have shifted. Improved corporate earnings and a steady decline in inflation have boosted the S&P 500 to new all-time highs.

Unique factors, particularly the boom in artificial intelligence, have led aggressive sectors to reclaim market dominance. The top three sectors contributing to annual gains in 2024 were information technology, communication services, and consumer discretionary, while defensive sectors like consumer staples and energy lagged behind.

Volatility and Institutional Selling in December

Cyclical sectors, such as industrials and financials, rebounded strongly in 2024 after trailing in 2023, as participation in the market rally improved. However, a slight reversal in market breadth was noted towards the end of the year. This kind of consolidation often signals stability for ongoing bull markets, although December saw considerable institutional selling, contributing to increased market volatility as the New Year approached.

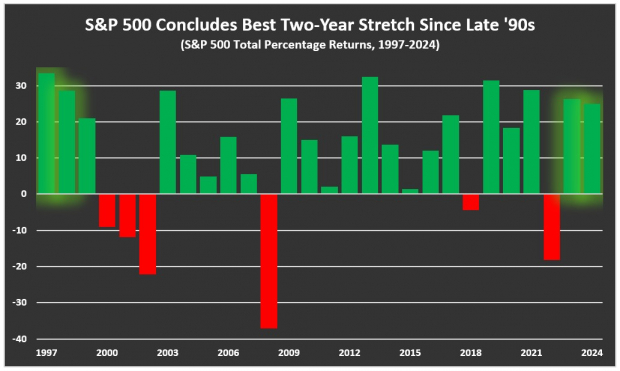

Despite this selling pressure, the S&P 500 closed the year with its highest consecutive annual gain in nearly 30 years:

Image Source: Zacks Investment Research

A Look at the Santa Claus Rally

The Santa Claus Rally, which includes the last five trading days of December and the first two of January, is historically one of the strongest periods for stock performance. So far, the S&P 500 has struggled during this timeframe, raising concerns for 2025 returns based on past trends. However, with two days still remaining, there is potential for a turnaround.

There has been discussion about concentration risk among the top companies in the S&P 500, suggesting that investor reliance is increasing on a smaller group of firms. Interestingly, only one of the top five companies by index weight ranked among the top three performers of 2024.

Top Performer: S&P 500 Gold – Palantir

Leading the S&P 500 in 2024 was Palantir PLTR, a key player in the artificial intelligence sector. The stock, ranked #2 (Buy) by Zacks, benefited from numerous upgrades and renewed government contracts last year.

Recently, Palantir extended its long-term partnership with the U.S. Army, enhancing the capabilities of its Army Vantage software that aids in crucial decision-making processes.

With nearly 60% of its revenue generated from government contracts, Palantir received a higher government rating this past December for its secure cloud computing services, positioning it well for growth. The stock, which joined the S&P 500 in September, yielded an impressive return of over 340% for investors:

Image Source: StockCharts

Analysts have raised their fiscal 2025 EPS estimates for Palantir by 9.3% in the last two months. The new Zacks Consensus Estimate stands at 47 cents per share, representing a 24% growth rate compared to the previous year.

Image Source: Zacks Investment Research

Second Place: S&P 500 Silver – Vistra Energy

Vistra VST was the second-best performer in the S&P 500. As a major power and electricity provider, the company capitalized on the growing demand from data centers.

The increasing use of artificial intelligence and nuclear energy as a clean power source have become significant drivers for utility stocks. Historically viewed as stable yet unexciting, utilities are now poised for growth as power demand is set to rise.

In its most recent quarterly report, Vistra exceeded earnings expectations and announced a $1 billion extension to its share repurchase program. After being added to the S&P 500 in May, the stock surged over 260% in 2024:

Image Source: StockCharts

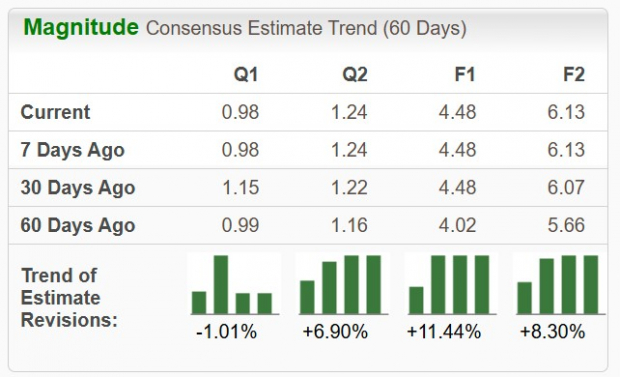

Looking ahead to 2025, analysts have upped their fiscal EPS estimates for Vistra by 8.3%, with the current Zacks Consensus Estimate at $6.13 per share, indicating strong growth potential with a 36.8% increase from last year.

Image Source: Zacks Investment Research

Third Place: S&P 500 Bronze – Nvidia

Nvidia NVDA rounded out the top three performers for the S&P 500 last year. As a leading semiconductor manufacturer, Nvidia has significantly benefited from the technology market’s revival and the rise of artificial intelligence.

Popular among data center operators, Nvidia’s GPUs are essential for companies like Amazon, Microsoft, and Alphabet as they expand operations. The company’s innovative approach to applying GPUs in artificial intelligence models helps it tap into new markets, including automotive, healthcare, and manufacturing.

Robotics is a critical growth area for Nvidia, which plans to release its next-generation compact computer for humanoid robots, named “Jetson Thor,” in early 2025.

Despite ending the year with a slight decline, NVDA shares still achieved a striking 171% return:

Image Source: StockCharts

Last year, Nvidia exceeded earnings expectations, reaffirming its status as a Zacks Rank #2 (Buy) stock. Analysts continue to raise estimates as the company approaches the fiscal fourth quarter’s end.

NVIDIA Set for Strong Financial Performance Amid Remarkable Growth

High Expectations for Earnings and Revenue Results

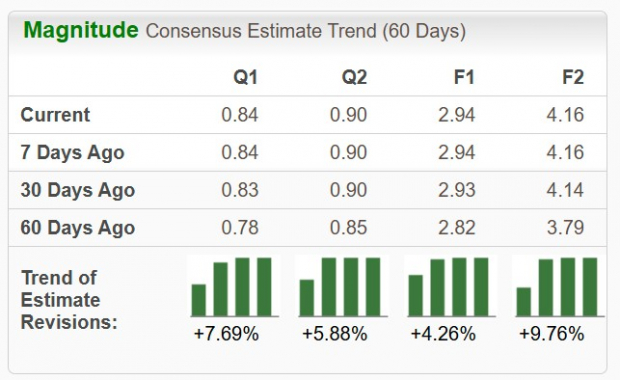

NVIDIA Corporation (NVDA) has seen its earnings estimates rise by 7.69% over the past two months. The Zacks Consensus Estimate is now at $0.84 per share, indicating an impressive 61.5% growth compared to the same period last year. Additionally, revenues are expected to surge by 70.7% to reach $37.7 billion in this quarter, with quarterly results slated for release in mid-to-late February.

Image Source: Zacks Investment Research

These growth figures are remarkable for a company of NVIDIA’s scale, reaffirming its status as a standout stock in the market.

Overview of Market Trends and Future Outlook

In 2024, technology companies were at the forefront of market advances. However, sectors like consumer discretionary also contributed significantly to the S&P 500’s performance. Investors are hopeful that the success of this year will translate into further growth in 2025.

The start of a new year is an ideal opportunity to reflect on achievements and identify areas for improvement. Analyzing top-performing companies can provide valuable insights and prepare investors for the coming year.

From all of us at Zacks, Happy New Year! Here’s to making 2025 your most rewarding investment year yet!

*Disclosure: Vistra (VST) is a portfolio holding in the Zacks Income Investor portfolio. Nvidia (NVDA) appears in the Zacks Headline Trader portfolio.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss your chance to explore our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has demonstrated significant success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has gained an astonishing +2,112.6%, outperforming the S&P 500’s +475.6%. Sheraz has reviewed 4,400 companies covered by the Zacks Rank to select the top ten stocks to buy and hold in the upcoming year. You can be among the first to uncover these newly announced stocks with exceptional growth potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download our free report on 5 Stocks Set to Double today!

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Vistra Corp. (VST): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.