West Japan Railway: A Strong Candidate for Global Diversification

While US equity markets are experiencing gains this week, driven by President Trump’s more conciliatory stance towards Federal Reserve Chair Jerome Powell and Treasury Secretary Bessent’s positive outlook on tariff negotiations, caution is warranted. Investors have leaned heavily into leading US stocks over the past two years due to the presence of many outstanding companies within the country’s borders. However, in the current macroeconomic landscape, diversifying into international and defensive-oriented stocks presents a compelling opportunity. One company that stands out is West Japan Railway (WJRYY), which may not be familiar to many US investors but deserves attention.

I’ll confess that West Japan Railway caught my attention after appearing on the Zacks Rank #1 (Strong Buy) list this week. Upon investigating its fundamentals, technical indicators, and the macroeconomic environment, it is evident that this stock has considerable appeal.

Image Source: Zacks Investment Research

West Japan Railway: A Cornerstone of Japanese Infrastructure

West Japan Railway operates a major transportation network throughout western Japan, including significant rail services like the Sanyo Shinkansen line, which links economic centers such as Osaka, Hiroshima, and Fukuoka. Beyond train operations, the company also runs buses and ferries, while expanding into real estate, retail, and tourism, creating a robust and diversified revenue stream.

Japanese railways are globally recognized for their efficiency, speed, and punctuality, and West Japan Railway exemplifies these qualities. The dedication to reliability and customer satisfaction extends across the company, making WJRYY desirable in a marketplace that values stability and consistent cash flow, even if it is not considered a high-growth stock.

WJRYY: Attractive Technicals and Valuation

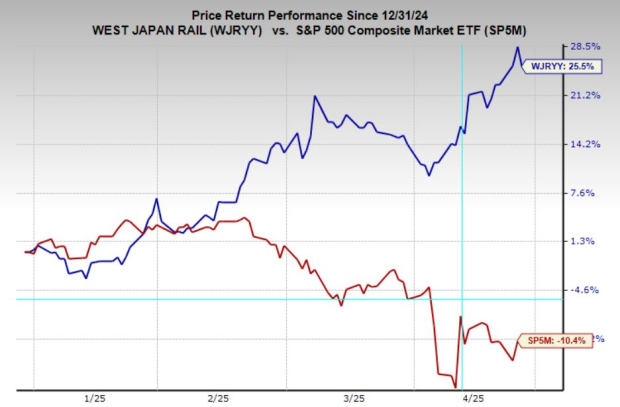

WJRYY is showing favorable price action compared to US equity indexes. After a lengthy recovery following the COVID-19 pandemic, the stock has recently broken out from a significant trading range, indicating a potential for upward momentum. This “stage-one breakout” often signals long-term trend changes, and the current setup appears increasingly promising.

Furthermore, the stock’s valuation reinforces a bullish outlook. Currently trading at 13.4x forward earnings, it is below its 10-year median of 14.9x and substantially lower than the industry average of 18.3x. This suggests that investors can acquire a high-quality infrastructure company within one of the world’s most stable economies at a favorable price.

Image Source: TradingView

Reasons to Consider Investing in WJRYY

As global capital turns towards diversifying away from US dollar-denominated assets amid increasing uncertainty, Japan emerges as a strong alternative. With a strengthening yen, attractive dividend yields, and a stable economy, Japanese equities, particularly West Japan Railway, are appealing for investors looking to gain international exposure without high risks.

Though WJRYY may not be on everyone’s radar, in today’s economic climate, it meets several investment criteria. It represents a high-quality, defensive investment with rising earnings estimates and an appealing valuation. For those aiming to enhance global diversification while minimizing volatility, West Japan Railway warrants attention.

Emerging Semiconductor Stock Highlighted

This new semiconductor stock, though only a fraction of NVIDIA’s size, shows significant potential for growth. With robust earnings growth and an expanding customer base, it is well-positioned to meet the burgeoning demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing industry is projected to grow from $452 billion in 2021 to $803 billion by 2028.

Stay informed by accessing more recommendations from reputable financial research sources.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.