2024’s Standout Stocks: Toast, Revolve, and On Surge in Value

In January 2024, the financial firm Baird identified Toast (NYSE: TOST) as one of its top picks in financial technology. This prediction proved accurate, with Toast’s shares rising by 100% throughout the year, significantly outperforming the S&P 500 index.

Toast wasn’t alone in achieving remarkable gains. Revolve (NYSE: RVLV) and On Holding (NYSE: ONON) also saw their stock prices double in 2024, with increases of 102% and 103%, respectively.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

A variety of stocks doubled or more in 2024, but Toast, Revolve, and On are worth examining together. These companies are lesser-known but have achieved impressive gains. Here’s a closer look at why they have prospered and which one holds the most promise for the long-term investor.

1. A Closer Look at Toast

When interest rates were near zero, profitability didn’t concern many investors. However, rising rates shifted perspectives, and companies with significant losses faced increased scrutiny. Toast, a restaurant technology firm, recorded net losses of $275 million and $246 million in 2022 and 2023, respectively. Fortunately, 2024 has shown a significant turnaround.

By the end of the first three quarters of 2024, Toast reported a much smaller net loss of $13 million, a stark contrast to the $231 million loss during the same period in 2023. The shift stemmed from a surge in revenue, coupled with careful management of operating expenses.

Toast’s approach to operating expenses has varied; it has kept general and administrative costs down by 17% while increasing spending on sales and marketing by 14% this year. This strategy shows that while the company is committed to growth, it is keeping a tight rein on corporate expenditures, leading to enhanced profitability prospects.

In the third quarter alone, Toast’s revenue soared by 26%, indicating robust growth. As Toast moves closer to profitability, it’s clear why the stock has doubled in value this year.

2. Understanding Revolve’s Resurgence

Revolve started 2024 with stock trading at about one times sales, making it one of its lowest-valued times ever. Known for its digital-first approach to fashion, Revolve attracts younger shoppers but struggled to maintain investor interest due to stagnant growth. However, in 2024, the stock’s value more than doubled as sales began to rise again.

Revolve operates on a different business model than traditional retailers, with an average order size of $303, which may limit mass appeal. Nevertheless, its active customer base of 2.6 million is increasing, reflecting a 5% growth in the last quarter.

Focusing on the high-end apparel market has enabled Revolve to maintain solid profitability, showing positive net income in every quarter since its public debut in 2019. With no debt and over $250 million in cash, the company’s foundation is strong.

The earlier concerns about lackluster growth have begun to diminish, as Q3 revenue saw a 10% increase with encouraging indicators for Q4, leading investors to react positively.

3. The Rise of On Holding

During the pandemic, major athletic footwear brands shifted towards direct-to-consumer sales, creating opportunities for younger brands like On to acquire market share. On’s net sales surged 69% and 47% in 2022 and 2023, respectively, signaling successful expansion.

In the first three quarters of 2024, On’s net sales increased another 27% compared to the same period last year. With about one-third of the sales made directly to consumers, On is gaining exposure and market share despite its lesser-known brand status.

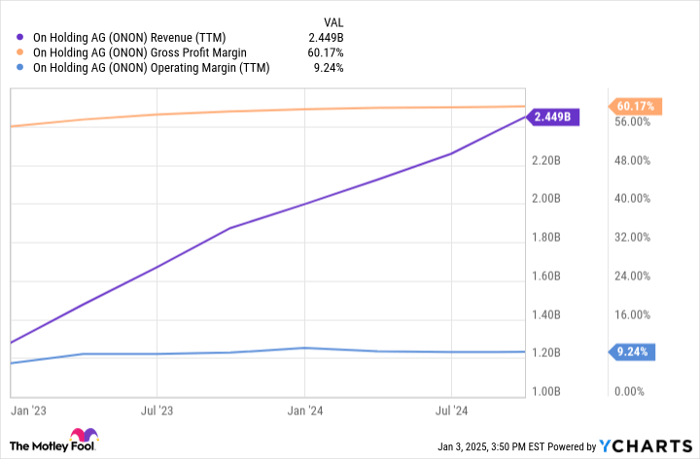

On’s remarkable revenue growth has allowed the company to maintain full-price sales, achieving a record gross margin above 60%, along with an operating margin of over 9%. These compelling financials have piqued investor interest.

As On continues to expand, there is ample room for further growth in the athletic shoe market.

My Investment Pick for 2025 and Beyond

While Revolve has demonstrated solid business viability, its market focus seems narrow, making long-term growth uncertain. A recent 10% revenue increase, though positive, suggests ongoing challenges, disqualifying it from my top pick.

On, with impressive growth and strong financials, presents its own set of risks. The unpredictable nature of consumer preferences in footwear can hinder establishing a solid competitive edge. Currently, its valuation of 15 times sales does not offer a favorable risk-reward ratio.

This leads me to endorse Toast as my preferred choice for 2025. One major factor is Toast’s projected growth potential tied to increasing market penetration. As more restaurants adopt its technology, the positive word-of-mouth effect can accelerate new business opportunities.

Toast is approaching critical market saturation across numerous U.S. regions. If this growth momentum carries forward and profits rise due to enhanced operational efficiencies, the stock could see substantial upside.

Is Investing $1,000 in Toast Right for You?

Before considering a stock in Toast, ponder this:

The Motley Fool Stock Advisor analyst team has recently spotlighted the 10 best stocks to invest in now, which did not include Toast. The stocks recommended could yield significant returns over the coming years.

For instance, if you invested $1,000 in Nvidia when it made this list on April 15, 2005… you’d have about $885,388 today!*

Stock Advisor equips investors with an easy path to successful investing, offering portfolio-building strategies, ongoing analyst updates, and two new stock picks monthly. This service has outperformed the returns of the S&P 500 since 2002.*

Discover the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Revolve Group and Toast. The Motley Fool recommends On Holding. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.