Core News Facts

Nvidia, the leader in AI infrastructure, commands over 90% of the GPU data center market, driven by demand for its high-performance graphics processing units (GPUs). In the last quarter, Nvidia reported a revenue increase of 62%, with sales tripling over the past two years. The company recently received U.S. approval to sell certain chips to China, further enhancing its growth potential.

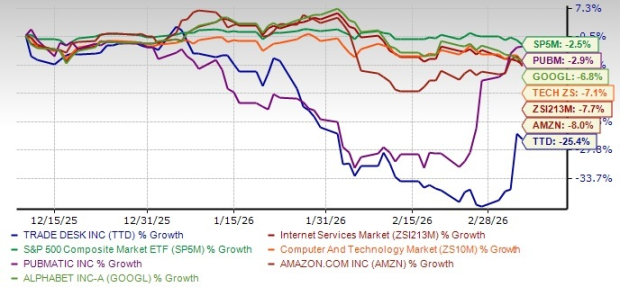

Alphabet, which owns Google, is positioned as a major player in AI, leveraging its comprehensive AI tech stack, including the Gemini large language model and custom Tensor Processing Units. Google Cloud experienced a 34% revenue jump last quarter, with operating income soaring 85% due to the integration of AI features into its services.

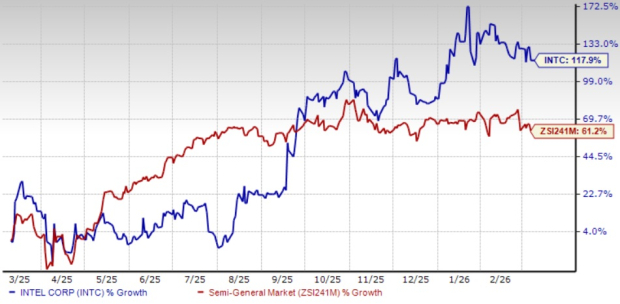

Taiwan Semiconductor Manufacturing (TSMC), the largest semiconductor manufacturer globally, is set to benefit from a mid-40% compound annual growth rate (CAGR) in AI chip demand over the coming years. TSMC’s ability to consistently produce advanced chips at small node sizes ensures its critical role in the AI supply chain, allowing it to raise service prices by 2026.