“`html

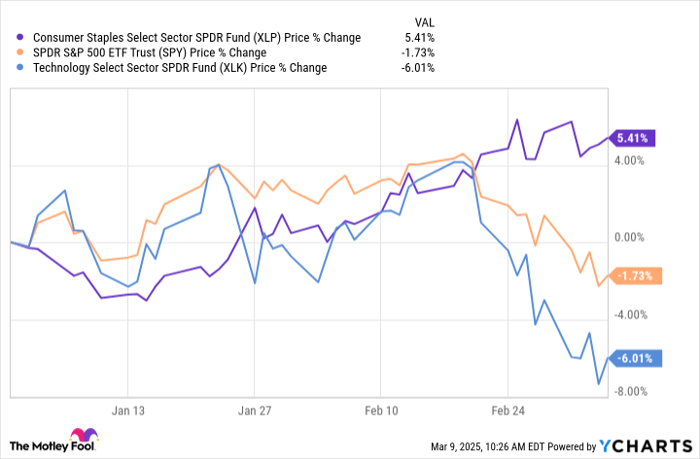

As of 2024, there has been a notable shift in investor sentiment on Wall Street, favoring the consumer staples sector, which has historically lagged behind technology and the broader S&P 500 index. Companies like PepsiCo and Hormel Foods are highlighted as Dividend Kings that have underperformed their peers yet offer high dividend yields of 3.5% and 3.8%, respectively.

PepsiCo reported a 2% increase in organic sales for 2024 and a 9% increase in adjusted earnings, but its stock has declined by 20% from its peak, reflecting slower growth expectations for 2025. In contrast, Hormel Food’s fiscal 2024 was weak, with a 1% increase in organic sales but an 11% drop in adjusted earnings. The company’s stock has lost 40% of its value over the last three years, in part due to challenges including production issues and slower recovery in China.

“`