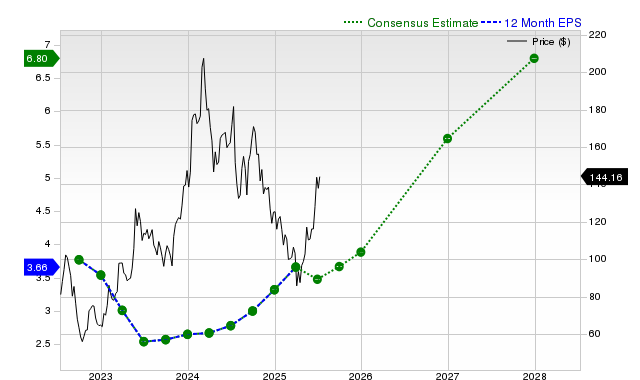

Ero Copper Corp. (ERO), a copper producer operating in Brazil, achieved commercial production at its Tucuma Operation on July 1, 2025. This milestone coincides with rising copper prices, recently hitting all-time highs above $5.50 per pound. Ero Copper reported approximately 6,400 tonnes of copper production in Q2 2025 and expects a 165% growth in earnings this year, up from $0.78 per share last year.

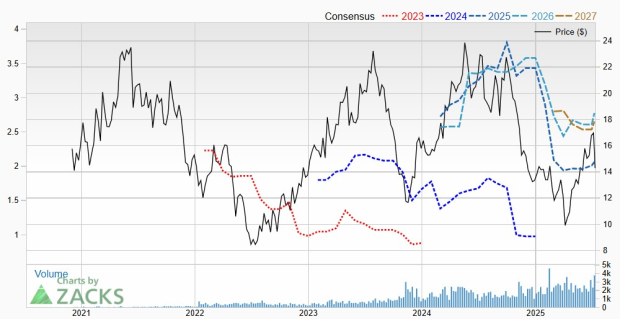

The company has a market cap of $1.5 billion and is heavily invested in two major operations: Caraiba, with a C1 cash cost of $2.22 per pound, and Xavantina, where C1 cash costs were $1,100 per ounce. Ero Copper reaffirmed its full-year expenditure guidance of $230 to $270 million and reported available liquidity of $115.6 million as of Q1 2025. Analysts have increased the 2025 Zacks Consensus Estimate to $2.07 per share from $2.02 following recent positive earnings revisions.

Despite a recent announcement of a 50% tariff on copper and goods from Brazil by President Trump, Ero Copper’s shares have rallied significantly in the past three months, boasting a forward price-to-earnings ratio of 6.9. The next earnings call is expected on July 31, 2025.