Lands’ End Showcases Strong Turnaround Potential in 2024

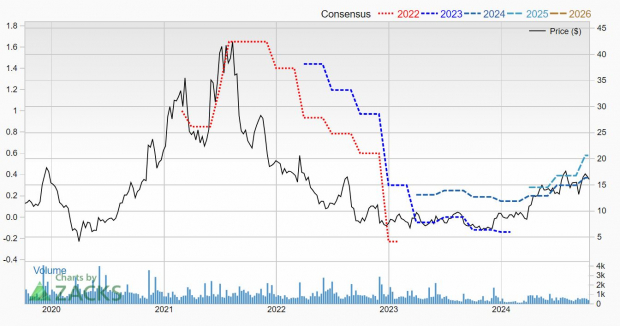

Lands’ End, Inc. LE is currently undergoing a significant turnaround, achieving a Zacks Rank #1 (Strong Buy). Earnings growth is projected to reach 346.7% in fiscal 2024.

Lands’ End is a prominent digital retailer specializing in apparel, swimwear, outerwear, accessories, footwear, home products, and uniforms. It operates through various channels, including online at landsend.com, company-owned stores, licensing agreements, and third-party distribution.

Additionally, it provides products to businesses and educational institutions via the Outfitters distribution channel.

Strong Performance in the Second Quarter of Fiscal 2024

On September 5, 2024, Lands’ End reported its fiscal second quarter results for 2024, surpassing the Zacks Consensus by 80%. The company recorded a loss of $0.02 per share compared to the expected loss of $0.10.

While Gross Merchandise Value (“GMV”) showed mid-single-digit growth compared to last year, revenue declined to $211.3 million, down from $218.7 million in the same quarter of fiscal 2023.

On a positive note, gross profit climbed 8.8%, reaching $151.9 million, up from $139.6 million last year.

Furthermore, gross margin increased by 470 basis points, now at 47.9%, compared to 43.2% in the second quarter of fiscal 2023. This improvement was attributed to product freshness, reduced promotional efforts, lower clearance inventory, and enhanced supply chain costs.

Significant Inventory Reduction

Many retailers have struggled with high inventory levels in recent years, but Lands’ End has succeeded in cutting its inventory. As of August 2, 2024, inventory decreased by 21%, totaling $312 million compared to $396.1 million on July 28, 2023.

This summer and fall, the company has experienced sellouts of several items, indicating effective inventory management that lessens the need for promotions.

As of August 2, 2024, Lands’ End reported cash and cash equivalents amounting to $25.6 million, a slight decrease from $26.6 million as of July 28, 2023.

Optimism for Fiscal 2024

Lands’ End is optimistic following its second quarter performance, projecting earnings between $0.29 and $0.48 for the fiscal year.

Consequently, analysts revised their earnings estimates, adjusting one higher for fiscal 2024 over the past 60 days. This led the Zacks Consensus estimate to increase from $0.30 to $0.37, aligning with the company’s guidance range and reflecting a remarkable earnings growth of 346.7% from a loss of $0.15 in the previous year.

Looking ahead to fiscal 2025, the Zacks Consensus anticipates an earnings projection of $0.58, signifying a further growth rate of 56.8%.

Image Source: Zacks Investment Research

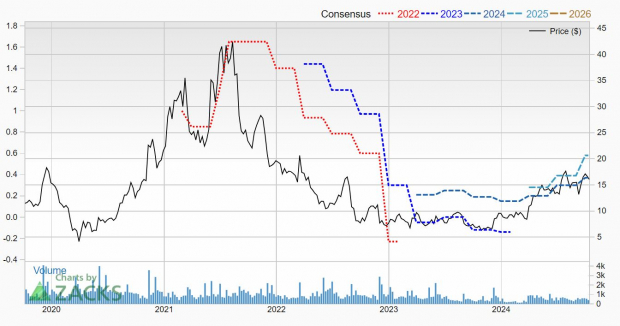

Lands’ End Stock’s Notable Ascent in 2024

With a promising outlook ahead, investors have increasingly turned to Lands’ End stock, which has surged 81.1% year-to-date, outperforming the S&P 500 index.

Image Source: Zacks Investment Research

Nevertheless, Lands’ End shares are trading at a high price-to-earnings ratio of 43.4x forward earnings.

Investors remain optimistic, driven by the anticipated earnings growth forecast. The upcoming holiday season will be crucial for the company’s continued success.

If you are on the lookout for a retailer with promising growth potential, Lands’ End deserves consideration.

Explore 7 Top Stock Picks for the Upcoming Month

Experts have compiled a fresh list of 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, which they label as “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market—doubling it with an annual average gain of +23.7%. Be sure to review these handpicked stocks promptly.

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to access this free report.

Lands’ End, Inc. (LE): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.