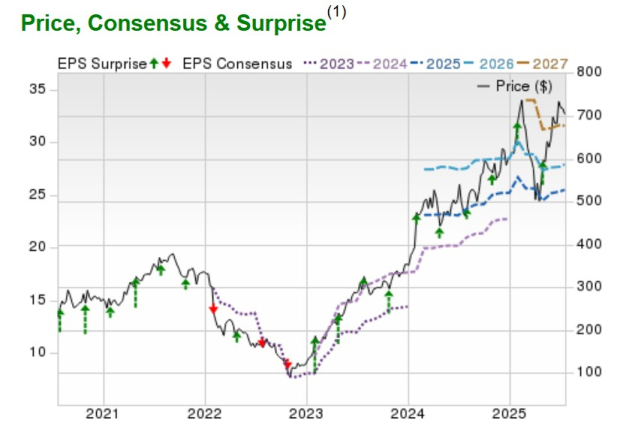

Meta Platforms, Inc. (META) is set to report its Q2 earnings on July 30, 2023. Analysts predict a sales increase of 14%, reaching $44.69 billion, and earnings per share (EPS) growth of 12% to $5.80, compared to $5.16 in the same quarter last year. These projections indicate potential ongoing success, as Meta has surpassed Zacks EPS consensus for 10 consecutive quarters.

In its AI infrastructure expansion, Meta is investing heavily in cutting-edge technology with plans for new data centers, including a 1-gigawatt facility in Ohio launching in 2026 and a 5-gigawatt campus in Louisiana. This infrastructure will support the company’s strong AI capabilities, which are expected to drive further growth and higher advertising revenue across its platforms.

Meta’s annual earnings are anticipated to grow by 7% this year and by 9% in FY26, reaching $27.89 per share. Notably, its stock valuation remains competitive, trading at just under 28 times forward earnings, making it the second cheapest among its major tech competitors.