A Bumpy Start

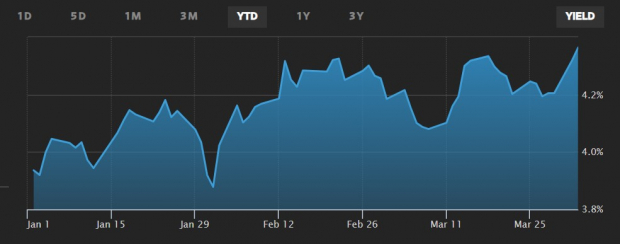

The recent market turbulence sent shockwaves as the medical sector grappled with a selloff after US regulators opted against raising payments for private Medicare plans, whilst manufacturing data hinted at stagnant commodity prices and cast doubt on anticipated Fed rate cuts for the second quarter. Investor unease was further fueled by the 10-year Treasury yield hitting a 2024 high of 4.37%, indicating a looming dichotomy as investors waver between fleeing bonds for riskier bets in stocks and vice versa.

Rising Stars

Nevertheless, amidst the storm of volatility, there are three standout stocks that shine brightly, waiting to be plucked like ripe fruit if the opportunity presents itself.

Kaiser Aluminum KALU: As aluminum prices plunge from their peak, Kaiser Aluminum stands out as a robust contender that thrived during the commodity price surge in recent years. Flourishing as a top producer of semi-fabricated specialty aluminum products across various end markets, Kaiser Aluminum anticipates substantial bottom-line growth. If aluminum prices rebound, the odds may further tip in Kaiser’s favor. With a 28% year-to-date stock surge and a lucrative 3.47% annual dividend yield, delving into Kaiser’s stock post-selloff could yield fruitful results.

Iron Mountain IRM: While most Real Estate Investment Trusts (REITs) hinge on stable conditions and rate cuts, Iron Mountain’s steadfast growth trajectory piques interest. Operating a global network of secure storage facilities and data centers, Iron Mountain exhibits a steady 13% year-to-date stock uptick. With a commendable 3.27% annual dividend yield and promising sales and earnings projections for 2024 and 2025, Iron Mountain distinguishes itself with a bright future amidst market uncertainties.

Sunoco SUN: Completing the triumvirate, Sunoco LP enters the fray as crude oil prices surge, reaching $85 a barrel. Bucking the downtrend in other commodities, Sunoco’s broad reach supplying motor fuel to over 10,000 US convenience stores positions it for growth. While Sunoco’s price performance remains flat this year, its enticing 5.61% annual dividend yield allures income investors. With escalating earnings per share estimates for FY24 and FY25, Sunoco paints a promising picture, hinting at short-term gains.

On a Positive Trajectory

Like Sunoco, Kaiser Aluminum, and Iron Mountain are riding the wave of optimistic earnings projections, all securing a Zacks Rank #1 (Strong Buy). Bolstered by a promising outlook and enticing dividends, these stocks present an enticing opportunity for investors to seize the dip and ride the upward trajectory in the face of market unpredictability.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.