As several expansive companies gear up to unveil their Q4 earnings on Wednesday, January 24, expectations run high for stellar quarterly growth. Among the top-rated Zacks stocks in the limelight, investors are eyeing some robust contenders with promising potential as their quarterly results approach.

Progressive Inc. (PGR): A Force to be Reckoned With

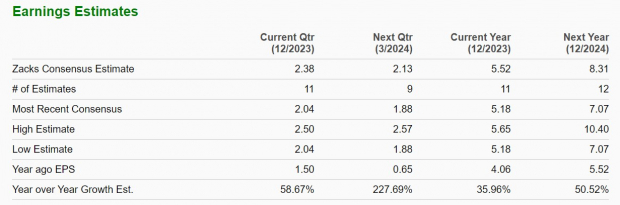

Progressive PGR: Home and auto insurance giant Progressive shouldn’t be overlooked ahead of its Q4 results with earnings projected to soar 58% to $2.38 per share versus $1.50 a share in the comparative quarter. Fourth quarter sales are expected to climb 19% to $16.1 billion. Plus, anticipation of high double-digit percentage growth on Progressive’s annual top and bottom lines is expected to continue in fiscal 2024.

Investors will want to take notice of Progressive’s Q4 results and guidance as PGR shares have risen +35% over the last year but still trade at a reasonable 20.4X forward earnings multiple considering the insurance leaders’ very expansive growth.

United Rentals (URI): Riding the Wave of Construction

Higher construction-related activities continue to boost United Rentals as well which is the largest equipment rental company in the world.

United Rentals’ Q4 earnings are projected to rise 11% to $10.85 a share with sales forecasted to be up 10% to $3.63 billion. United Rentals is now expected to round out FY23 with EPS up 24% to a whopping $40.40 per share and total sales projections of $14.23 billion would be a 22% increase from $11.64 billion in 2022. The possibility of positive guidance looks likely with FY24 EPS and sales projected to rise another 7% and 3% respectively.

Many eyes will be on United Rentals’ Q4 report as URI shares have rallied +47% over the last year and still trade at 13.1X forward earnings, which is a slight discount to the Zacks Building Products-Miscellaneous industry average of 16.3X.

Other Stocks to Watch

International Business Machines IBM and Abbott Laboratories ABT are two other companies to keep an eye on in regards to Wednesday’s earnings lineup. Both have a market edge as it relates to computer and healthcare products respectively with sound quarterly growth expected. Notably, Abbott’s stock is virtually flat over the last year while IBM shares have risen +22%.

The Progressive Corporation (PGR) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Abbott Laboratories (ABT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.