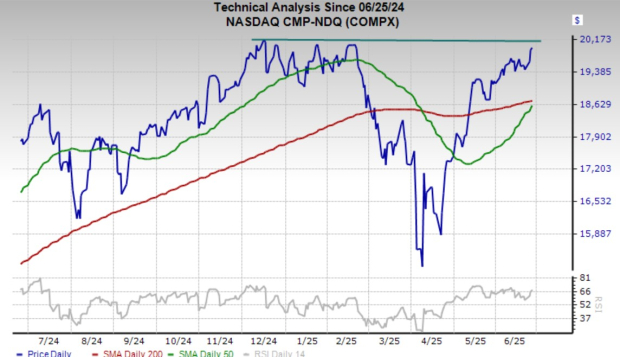

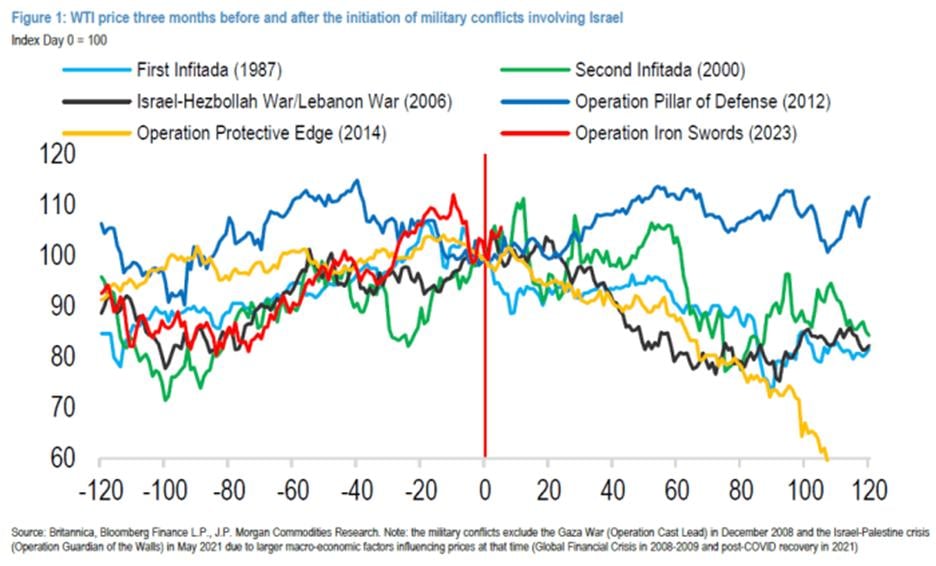

Nvidia’s stock reached an all-time high on Wednesday, pushing the Nasdaq-100-tracking QQQ ETF to fresh records. This surge followed a potential cease-fire agreement between Israel and Iran, supported by President Trump, amid decreasing tensions in the Middle East. The broader S&P 500 and Nasdaq also edged closer to their peaks, while Wall Street anticipates strong second-quarter earnings amidst cooling inflation and trade deals.

Rockwell Automation, Inc. (ROK), based in Milwaukee, Wisconsin, topped earnings estimates for Q2 FY25 and has seen a projected earnings boost of 16% for FY26. Its stock has jumped 13% in 2025, supported by advancements in industrial automation in collaboration with Nvidia.

Credo Technology Group (CRDO) experienced a revenue growth of 126% for fiscal 2025, with adjusted earnings rising from $0.09 to $0.70. Forecasts suggest growth of 111% in adjusted earnings for FY26, with revenue projected to reach nearly $1 billion by FY27. CRDO’s stock has surged 440% in the past two years, outperforming Nvidia’s 280% gain.