Tech Stocks to Watch in 2025: Micron and Roku Stand Out

As the artificial intelligence (AI) surge continues into early 2025, many tech stocks are experiencing significant growth. The economy has recently improved, allowing fast-growing companies to access low-cost financing more easily. Following a steep decline in 2022, many of last year’s leading stocks are regaining lost ground as investor sentiment turns positive.

However, a few tech stocks have quietly strengthened their business outlooks irrespective of market trends. Among these, Micron Technology (NASDAQ: MU) and Roku (NASDAQ: ROKU) present excellent investment opportunities right now.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy today. See the 10 stocks »

1. Micron Technology

Micron, a leader in memory chip production, plays a crucial role in the AI boom.

Large language models (LLMs) like ChatGPT require powerful processors from companies like Nvidia (NASDAQ: NVDA) and Advanced Micro Devices (NASDAQ: AMD). However, these processors depend on sufficient high-speed RAM and NAND storage. As the demand for AI technology increases, so does the need for memory chips.

The total addressable market (TAM) for high-bandwidth memory (HBM) reached $16 billion last year and is projected to quadruple within three years, potentially hitting $100 billion by 2030.

Micron’s CEO, Sanjay Mehrotra, expressed excitement about the growth opportunities in a recent earnings call, stating, “This HBM growth will be transformational for Micron.”

Nvidia’s advanced AI accelerators currently incorporate Micron’s HBM3E memory, and the company plans to increase production of its next-generation HBM4 line, which promises 50% higher performance and reduced power usage.

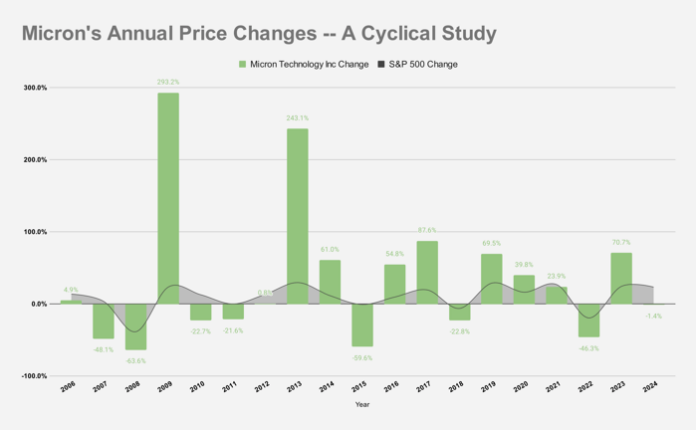

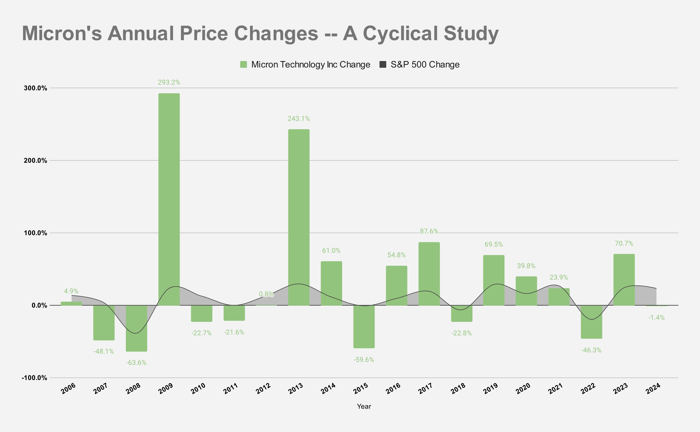

Data collected from Google Finance on Jan. 24, 2025. Chart by author.

Micron is well-positioned for growth in a cyclical market where demand fluctuates yearly. While its stock rose in 2023 after a challenging 2022, where inflation and a global chip shortage impacted the semiconductor industry, it has recently stagnated.

Looking ahead, Micron anticipates a rebound in demand from the AI sector, with expectations of improved profit margins. The stock’s price-to-earnings (P/E) ratio may drop from 30 times trailing earnings to just 9 times projected earnings for next year—an attractive opportunity for investors.

2. Roku

Roku, known for its media-streaming technology, may not appear favorable at first. The company has struggled with profitability and negative operating income, with analysts not forecasting positive earnings for 2025. Nevertheless, the shares have dropped 11% in the past year and now trade at just 3.0 times trailing sales.

Despite surface concerns, Roku remains a leading player in the North American streaming market. Its platform enhances how users engage with services like Netflix (NASDAQ: NFLX), Walt Disney, and Warner Bros Discovery, making it essential for a successful home viewing experience.

Roku is also targeting global expansion, having started to penetrate Latin America and select European markets. However, it doesn’t yet report international sales, leaving potential growth unrealized as players like Netflix earn 56% of their revenues outside the U.S.

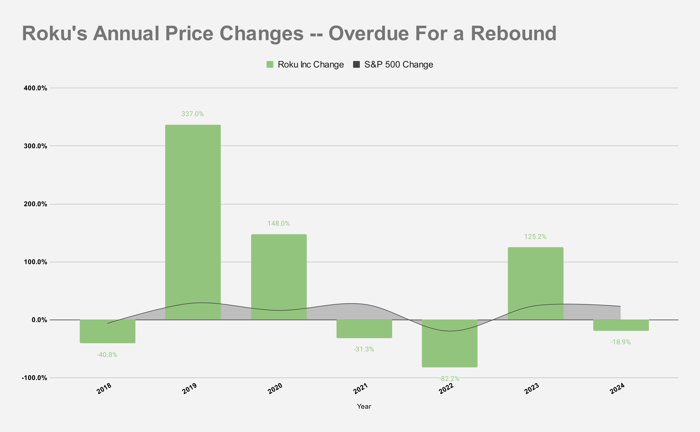

Data collected from Google Finance on Jan. 24, 2025. Chart by author.

The digital advertising sector took a hit during the inflation crisis, but as consumer spending returns to normal, Roku might benefit from increased advertisement revenue.

Much like Micron, Roku appears undervalued as of January 2025.

Capitalizing on Investment Opportunities

Ever feel like you missed the chance to invest in the hottest stocks? Now might be your moment.

Our analysts occasionally identify a “Double Down” stock, which they believe is poised for growth. With companies currently under the radar, now could be the time to invest—before prices climb:

- Nvidia: Investing $1,000 in 2009 would have yielded $369,816!*

- Apple: A $1,000 investment in 2008 would grow to $42,191!*

- Netflix: Invest $1,000 in 2004, and it’d be worth $527,206!*

Currently, we’re giving “Double Down” alerts for three promising companies, and the opportunity may not come around again soon.

Learn more »

*Stock Advisor returns as of January 21, 2025

Anders Bylund has investments in Micron Technology, Netflix, Nvidia, Roku, and Walt Disney. The Motley Fool has positions in and recommends Advanced Micro Devices, Netflix, Nvidia, Roku, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.