Technology Bargains: Two Stocks to Consider Now

The recent market pullback has created attractive opportunities in the technology sector. Although under short-term pressure, tech has been a standout investment area over the last ten years. Many of the largest and most impactful companies globally are rooted in technology or have significant tech elements.

Here, we examine two leading tech firms that present compelling buying opportunities right now.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider. Learn More »

1. Alphabet

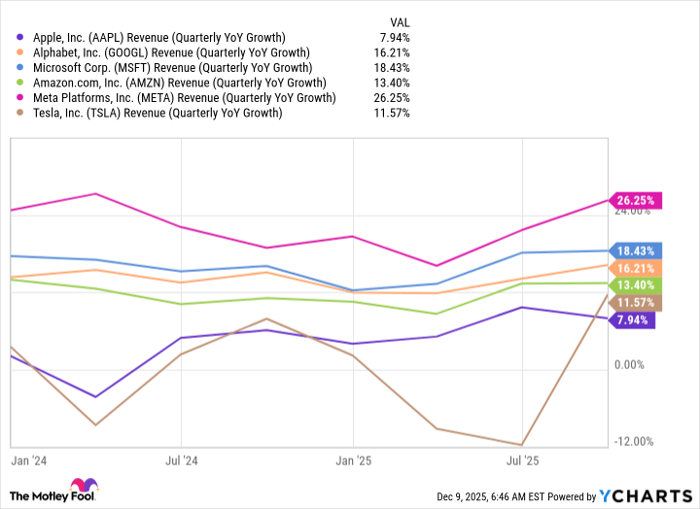

Alphabet (NASDAQ: GOOGL), (NASDAQ: GOOG) is widely recognized for its Google search engine, but the company offers much more. As the largest digital advertising platform globally, it delivers ads through its own channels and third-party sites. This includes not only Google but also YouTube, the leading video platform in the U.S.

Moreover, Alphabet stands as the third-largest cloud computing provider with Google Cloud, which has been its fastest-growing segment, driven by increasing demand for artificial intelligence (AI). Last quarter, cloud revenue soared 30%, and operating income jumped an impressive 142%. As the cloud business hits scale, its profitability is improving significantly.

Additionally, Alphabet has developed its AI chip, Trillium, in collaboration with Broadcom. This chip, along with GPUs, has resulted in faster processing times and reduced costs, providing a competitive advantage during the current AI infrastructure boom. The company also utilizes its foundational AI model, Gemini 2.0, which developers can leverage for their own AI applications.

Besides AI endeavors, Alphabet is pioneering in quantum computing and autonomous driving technology. Last year, its Willow chip made waves in quantum computing by addressing a longstanding issue of error reduction as it scales up.

In the realm of autonomous vehicles, Alphabet’s Waymo unit is the only robotaxi service in the U.S. offering paid rides, functioning in multiple cities. Trading at a forward price-to-earnings (P/E) ratio of approximately 19 times 2025 analyst estimates, Alphabet is positioned as one of the most undervalued mega-cap tech stocks in the AI space.

Image source: Getty Images.

2. Meta Platforms

Likewise, Meta Platforms (NASDAQ: META) is a heavyweight in the digital advertising arena. Unlike Alphabet, which relies on search and long-form video, Meta connects advertisers to users across its social media and messaging platforms. Its portfolio includes Facebook, Instagram, Threads, WhatsApp, and Messenger.

Meta has successfully attracted users, posting 3.35 billion daily active accounts as of last year. What sets Meta apart from competitors is its ability to monetize its user base effectively. In the fourth quarter, it recorded an impressive average revenue per user (ARPU) of $14.25, significantly surpassing rivals Snap at $3.44 and Pinterest at $2.12.

Furthermore, the company continues to experience growth by increasing ad impressions and pricing. In the last quarter, ad impressions grew by 6%, while ad prices surged by 14%, resulting in a hefty 21% increase in overall ad revenue. These indicators highlight both the effectiveness of Meta’s advertisements and strong market demand.

Meta is heavily investing in AI with its Llama AI model, aiming to enhance user engagement and better connect advertisers to their target audiences. The company is also developing its Llama 4 model, which promises multimodal capabilities and aspirations to become the leading personalized AI assistant, Meta AI. With investments in smart glasses and the Quest virtual reality headset, Meta maintains ambitious plans for its metaverse project.

A significant potential growth catalyst is its newer platform, Threads, which achieved 320 million monthly active users by year-end and is gaining about 1 million new users daily. Historically, Meta has effectively built audiences before monetizing them, suggesting that Threads could become a substantial revenue driver as it matures.

With a forward P/E of about 25.5 times 2025 analyst projections, Meta appears attractively valued given its growth prospects and future opportunities.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Feeling like you missed out on the top-performing stocks? It’s worth noting that our expert analysts occasionally issue a “Double Down” Stock recommendation for companies poised for significant gains. If you’re concerned you’ve missed your chance to invest, now is an optimal moment before prices rise further. The numbers tell an impressive story:

- Nvidia: $1,000 invested when we made a double down in 2009 would now be worth $292,207!*

- Apple: $1,000 invested when we doubled down in 2008 would now equate to $45,326!*

- Netflix: $1,000 invested during our double down in 2004 has soared to $480,568!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and opportunities like this rarely come along.

Continue »

*Stock Advisor returns as of March 3, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet and Pinterest. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Pinterest. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.