Key Points

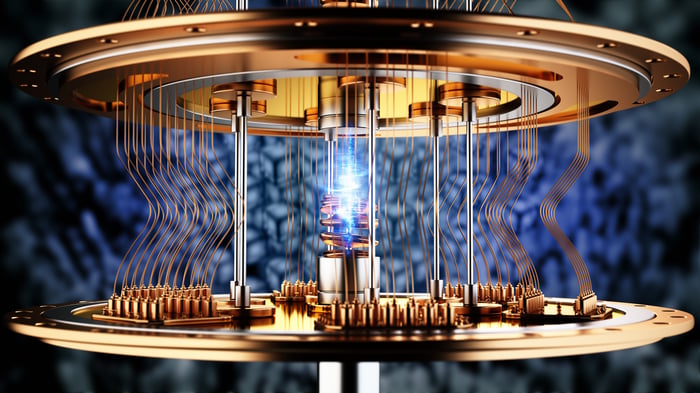

Wall Street’s current bull market, ongoing since early 2023, has seen substantial gains: the Dow Jones Industrial Average is up 45%, the S&P 500 by 78%, and the Nasdaq Composite by 122%. This rally is largely driven by the impressive performance of growth stocks, with predictions for significant revenue increases in 2026. Notably, companies like AST SpaceMobile (NASDAQ: ASTS) are expected to see sales surge by 1,200% in 2025 to $57.3 million, followed by a 311% rise to $235.6 million in 2026; Rigetti Computing (NASDAQ: RGTI) forecasts a sales growth of 169%, reaching $20.5 million; and Nebius Group (NASDAQ: NBIS) anticipates a staggering 521% increase to $3.45 billion.

AST SpaceMobile is capitalizing on partnerships with over 50 mobile network providers covering nearly 3 billion subscribers. Meanwhile, Rigetti’s alignment with major players like Amazon and Microsoft highlights the strong potential of quantum computing. In the case of Nebius Group, partnerships include a $17.4 billion five-year deal with Microsoft, reflecting the soaring demand for AI infrastructure. However, the high valuations of these companies raise questions about sustained growth, with AST SpaceMobile’s current market cap at $33.3 billion and Rigetti’s price-to-sales ratio indicating potential market overvaluation.