AI-Driven Earnings: What to Expect from Vertiv and Super Micro

As we navigate through the 2024 Q4 earnings season, positive trends are emerging. Next week brings significant updates from major players in the AI sector, including Vertiv (VRT) and Super Micro Computer (SMCI).

Vertiv: Powering the Future

Vertiv specializes in services for data centers, communication networks, and industrial facilities with a strong offering in power, cooling, and IT infrastructure. Analysts remain optimistic about Vertiv’s earnings and sales, with a forecast indicating 50% growth in earnings per share (EPS) and a 15% increase in sales. This growth is largely attributed to the rising demand for AI infrastructure solutions.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Super Micro Computer: Innovating IT Solutions

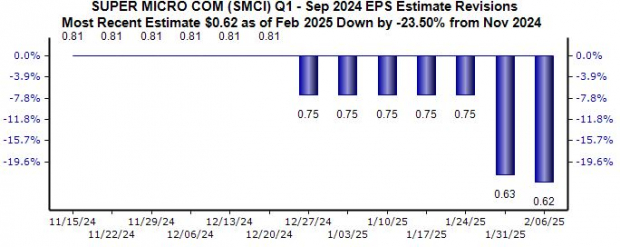

Super Micro Computer offers comprehensive IT solutions spanning AI, Cloud, Storage, and 5G/Edge services, which explains the growing interest in its stock. However, EPS estimates have dropped in recent months. Currently, the consensus estimate stands at $0.62 per share, suggesting a modest 10% increase.

Sales forecasts are also revised downwards, with estimated revenue at $5.8 billion, reflecting a 5% decrease compared to earlier expectations, yet still pointing to an impressive 60% year-over-year growth. This indicates that, similar to Vertiv, Super Micro has experienced significant revenue growth recently.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion: Key Earnings Ahead

As the 2024 Q4 earnings cycle unfolds positively, all eyes will be on the updates from Super Micro Computer (SMCI) and Vertiv (VRT) next week. The guidance provided during these earnings calls will be crucial for gauging how investors respond after the results.

Energy’s Bright Future: The Nuclear Option

The demand for electricity is soaring while the world seeks to reduce reliance on fossil fuels. Nuclear energy presents a viable alternative.

Recently, leaders from the U.S. and 21 other countries committed to dramatically increasing the world’s nuclear energy capacity. This shift may lead to substantial profits for nuclear-related stocks, particularly for investors who act quickly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights the key players and technologies shaping this shift, featuring three standout stocks poised for growth.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Super Micro Computer, Inc. (SMCI): Free Stock Analysis Report

Vertiv Holdings Co. (VRT): Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.