“`html

Toyota Motor (NYSE: TM) reported a dividend yield of 3.2% and delivered 1.60 million cars to U.S. customers in the first three quarters of 2025, positioning it ahead of Ford’s 1.57 million and Tesla’s 404,500 vehicles. The company’s dividend adjustments are based on actual cash generation rather than maintaining a long-term payout streak, having previously reduced its payout during the financial crises of 2008 and 2022.

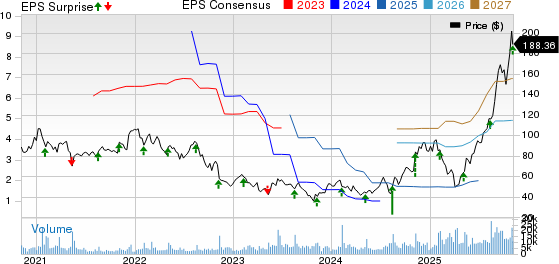

Texas Instruments (NASDAQ: TXN) offers a 3.4% dividend yield and has increased its dividend annually since 2004, despite a 21.2% decrease in its stock price over the past year. The company is focused on enhancing its cash flows and is seeing a resurgence in sales of industrial chips and analog processors.

“`